In real estate, investors face a choice between short-term gains and long-term stability. Short-term equity focuses on immediate trends for quick returns in competitive areas, while access equity prioritizes a property's future value through neighborhood development and appreciation potential. Short-term investments offer flexibility and potential lucrativeness, attracting young professionals, retired persons, and those with limited capital. In competitive markets, staying informed, using data analytics, and building relationships can help secure exclusive off-market opportunities.

In today’s dynamic real estate landscape, understanding short-term and access equity is crucial for investors. This article delves into these concepts, exploring their significance and benefits, particularly in navigating volatile markets. We examine how short-term investments can offer lucrative opportunities while discussing strategies to overcome access equity challenges. By gaining insights into these key aspects, real estate professionals can make informed decisions, ensuring success in a constantly evolving industry.

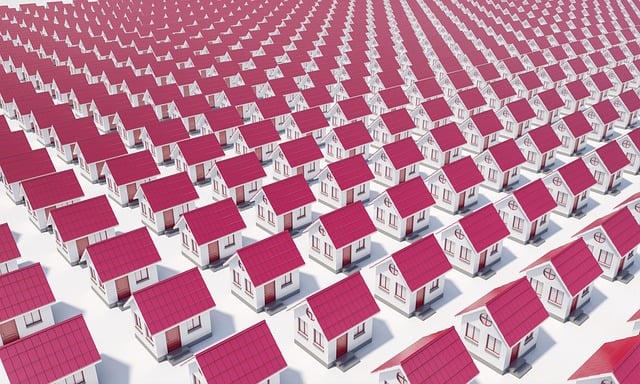

Understanding Short-Term and Access Equity in Real Estate

In the dynamic realm of real estate, understanding short-term and access equity is crucial for both investors and buyers. Short-term equity refers to the value of a property over a brief period, often focused on the immediate market conditions and trends. It considers factors like current demand, rental income potential, and the expected turnover time. Investors seeking quick returns or those looking to flip properties often emphasize short-term equity, aiming for rapid gains in a competitive market.

Access equity, on the other hand, delves into the long-term value and accessibility of real estate. It involves assessing the property’s stability, neighborhood development, and future market potential. Investors focused on access equity aim to secure properties that appreciate over time, providing consistent returns despite short-term market fluctuations. This approach is popular among those seeking stable, sustainable investments in a given area or demographic.

The Benefits of Short-Term Investments in Real Property

Short-term investments in real estate offer a unique and appealing opportunity for those seeking financial gains with less time commitment compared to traditional property ownership. This strategy allows investors to tap into the lucrative market of real estate without the long-term responsibilities, making it an attractive option for various individuals, from young professionals to retired persons. The primary benefit lies in the potential for quick returns; short-term investments often involve flipping properties, where investors purchase undervalued real estate, renovate or remodel, and then resell at a higher price, generating significant profits within months.

Additionally, these investments provide access to diverse real estate opportunities. Investors can explore different markets, target specific neighborhoods, or focus on specific property types like residential, commercial, or industrial. This accessibility opens doors to hidden gems in bustling cities or emerging rural areas, offering the chance to capitalize on untapped potential. Moreover, short-term investments often involve lower entry barriers, making them democratic options for those looking to enter the real estate space without substantial capital.

Strategies for Navigating Access Equity Challenges in Real Estate Markets

In the competitive real estate markets, access equity challenges often arise due to factors like limited properties available and high demand from eager buyers. To navigate these hurdles, professionals can employ strategic approaches. First, staying informed about market trends and early insights into new listings can provide an edge. Utilizing advanced data analytics tools enables agents to identify emerging patterns and predict potential hot spots, ensuring clients gain access to sought-after properties.

Additionally, building strong relationships with developers and property owners is invaluable. These connections facilitate exclusive access to off-market opportunities, which are often more affordable than competing listings. By fostering these networks, real estate professionals can offer their clients a competitive advantage in securing equity positions before they hit the open market.