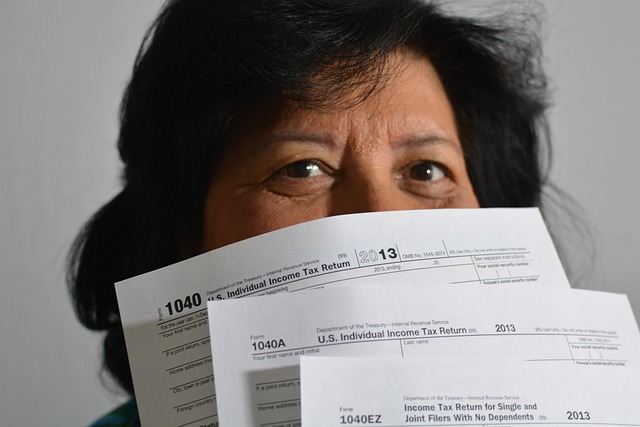

Understanding real estate ownership costs is crucial for both buyers and investors, as these expenses go beyond the initial purchase price. Key factors influencing costs include location, property type, and age. Effective management of these costs (property taxes, insurance, maintenance, etc.) allows informed decision-making, accurate commitment assessments, and sustainable financial choices in the competitive real estate market.

In the competitive world of real estate, understanding and managing ownership costs is paramount for maximizing returns on investments. This article delves into the multifaceted aspects of ownership costs, providing a comprehensive guide for both seasoned investors and newcomers alike. From defining and decomposing these costs to identifying savings opportunities and implementing long-term strategies, we explore practical steps to significantly reduce overall expenses. By leveraging insights into property maintenance, energy efficiency, financing options, and technology, readers can navigate the real estate landscape with enhanced financial acumen.

Understanding Ownership Costs in Real Estate

In the realm of real estate, understanding ownership costs is paramount for both investors and prospective buyers. These costs extend far beyond the initial purchase price, encompassing a myriad of expenses that significantly impact overall financial burden. From property taxes and insurance to maintenance, repairs, and potential association fees, each aspect contributes to the intricate tapestry of ownership expenditures. By comprehending these multifaceted costs, individuals can make more informed decisions regarding their real estate investments, ensuring long-term financial sustainability.

Navigating the world of real estate involves recognizing that the true value of a property is not solely determined by its market value but also by the associated ongoing costs. These expenses can vary widely depending on factors such as location, property type, and age. For instance, homes in bustling metropolitan areas often come with higher property taxes and insurance premiums compared to quieter suburban neighborhoods. Similarly, older properties may require more frequent maintenance and repairs, adding to the overall ownership cost equation. Being aware of these dynamics is crucial for budgeting, planning, and strategic real estate management.

– Definition and Components of Ownership Costs

Ownership costs in real estate encompass a range of expenses associated with purchasing and maintaining a property. These costs go beyond the initial purchase price, including various ongoing expenditures that significantly impact overall financial burden. The primary components include property taxes, insurance, maintenance and repair fees, utility bills, and sometimes even landscaping or home association dues. Each of these elements contributes to the overall expense, making it crucial for owners to understand and manage these costs effectively.

In the competitive real estate market, buyers and investors must consider these ownership costs to make informed decisions. By factoring in these ongoing expenses, individuals can better assess the long-term financial commitment required to own a property, ensuring they make sustainable choices that align with their financial capabilities.

– Factors Influencing Ownership Expenses

Various factors play a pivotal role in shaping the overall expenses associated with real estate ownership. One of the primary considerations is the location of the property. Urban areas, known for their bustling landscapes and high demand, often come with significantly higher ownership costs compared to suburban or rural locales. This disparity is driven by factors like property taxes, which tend to be more substantial in urban centers, reflecting the increased infrastructure and service demands.

Another influential factor is the size and age of the property. Larger properties generally incur higher maintenance expenses due to larger square footage and potential additional structures. Similarly, older real estate may require more frequent repairs and renovations, adding to the financial burden. Additionally, energy efficiency and the subsequent utility costs can vary widely among properties, with newer constructions often boasting enhanced insulation and energy-saving features that reduce ownership expenses over time.