FHA financing, backed by the Federal Housing Administration, offers a welcoming gateway to homeownership for first-time buyers with lenient credit requirements, lower down payments, competitive interest rates, and flexible terms. This program, designed for budget-conscious buyers, breaks financial barriers and fosters an inclusive real estate landscape. To navigate this process successfully, gather essential documentation, research the market, seek pre-approval, and maintain clear communication with lenders.

“Thinking of entering the real estate market as a first-time buyer? FHA financing could be your key to unlocking homeownership. This article guides you through the process, offering a comprehensive ‘Understanding FHA Financing’ primer, exploring the benefits and requirements for making homeownership more accessible, and providing essential tips for a smooth purchase experience. Dive into these insights and take charge of your real estate journey.”

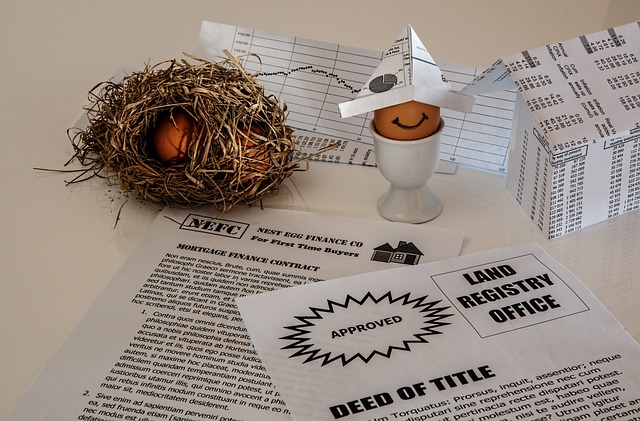

Understanding FHA Financing: A Primer for First-Time Buyers

For first-time buyers navigating the real estate market, understanding FHA financing can open doors to homeownership. FHA, or Federal Housing Administration, offers a unique lending program designed specifically for those taking their first steps into the world of homeownership. This government-backed loan program is particularly appealing due to its lenient credit requirements and lower down payment mandates compared to conventional loans.

The benefits extend further; FHA loans often come with competitive interest rates, making them an attractive option for budget-conscious buyers. These loans are also flexible, allowing borrowers the freedom to cancel mortgage insurance once certain equity thresholds are met. This primer serves as a starting point for first-time buyers to grasp the fundamentals of FHA financing and explore how it can facilitate their journey into the real estate realm.

Benefits and Requirements: Making Homeownership Accessible

For first-time homebuyers, navigating the real estate market can seem daunting, but FHA financing offers a lifeline, making homeownership more accessible and affordable. This government-backed loan program removes many of the financial barriers that often stand between aspiring homeowners and their dream homes. Benefits include lower down payment requirements, flexible credit score criteria, and competitive interest rates, all designed to support those taking their first steps into the real estate world.

FHA financing empowers buyers by providing a clear path to homeownership. These loans are particularly attractive for low-to-moderate income earners who may struggle to meet conventional lending standards. By easing financial constraints, FHA financing opens doors to otherwise unreachable opportunities, fostering a more inclusive and diverse real estate market. It’s about giving everyone a fair chance at securing their piece of the American dream.

Navigating the Process: Tips for a Smooth FHA Purchase

Navigating the process of purchasing your first home can be exciting yet daunting, especially when considering FHA financing. Here are some tips to ensure a smooth experience. First, understand that an FHA loan requires specific documentation, so gather all necessary papers well in advance. This includes proof of income, employment history, and identity documents. Stay organized throughout the process to avoid delays.

Additionally, research the real estate market to get a clear understanding of property values and current interest rates. Pre-approval for your loan before shopping for homes can demonstrate your seriousness to sellers and give you a competitive edge. Remember, clear communication with your lender is vital; they can guide you through each step, ensuring a successful FHA purchase.