Flexible Revolving Credit (FRC) offers homeowners a dynamic, equity-based financial solution in the real estate market, enabling them to fund improvements, consolidate debt, and manage expenses with flexible repayment options. Lenders provide various repayment plans, including interest-only periods, and interest rates can be variable for potential savings or fixed for stability. Homeowners should compare rates from different lenders to make informed decisions about leveraging FRC for home-related expenses in the evolving real estate landscape.

“In today’s dynamic real estate landscape, homeowners are seeking flexible financial solutions. Enter flexible revolving credit—a game-changer for property owners looking to unlock equity without traditional mortgages. This article explores how this innovative approach allows you to access cash flow while retaining control of your home. We’ll delve into the benefits, repayment dynamics, and interest considerations, empowering folks to make informed decisions regarding their real estate investments.”

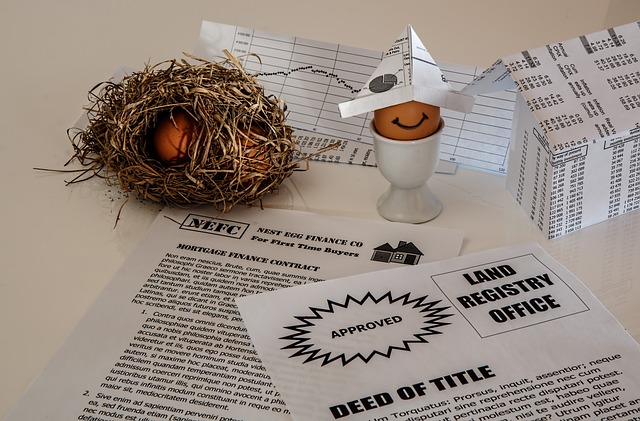

Understanding Flexible Revolving Credit in Real Estate

In the realm of real estate, Flexible Revolving Credit (FRC) offers a dynamic financial solution for homeowners seeking flexibility and control over their funds. This innovative credit option allows property owners to borrow money against the equity in their homes, providing a pool of accessible funds that can be used for various purposes. Unlike traditional loans with fixed terms, FRC offers a revolving line of credit, enabling borrowers to access, repay, and reborrow funds as needed, making it an attractive option for homeowners who value adaptability.

The beauty of FRC lies in its versatility. Homeowners can utilize these funds for home improvements, debt consolidation, or even unexpected expenses without the pressure of adhering to strict repayment schedules. This credit facility is particularly beneficial for real estate investors and those with fluctuating financial needs, as it provides a safety net and the freedom to manage cash flow more effectively. Understanding FRC can empower homeowners to make informed decisions regarding their financial future in the ever-evolving real estate market.

Benefits for Homeowners: Accessing Unlocked Equity

For homeowners, one of the key benefits of a flexible revolving credit is the ability to access unlocked equity in their real estate investments. This means they can tap into the value of their homes without the constraints of traditional mortgages. Whether it’s for home improvements, debt consolidation, or unexpected expenses, this line of credit offers financial flexibility and peace of mind.

By utilizing a flexible revolving credit, homeowners gain access to funds that can be drawn down as needed, repaying both principal and interest at their own pace. This approach allows them to manage cash flow more effectively, potentially saving on interest costs in the long run. Moreover, it provides an opportunity to build equity faster by making additional payments beyond the minimum required, thereby enhancing their financial position in the real estate market.

Navigating the Repayment Process and Interest Rates

Navigating the repayment process for a flexible revolving credit is designed to be straightforward and tailored to homeowners’ needs in the dynamic real estate market. Lenders offer various options, allowing borrowers to make interest-only payments during certain periods, which can help manage cash flow. Repayment typically begins after a grace period, with regular principal and interest payments spread over an agreed-upon term.

Interest rates play a crucial role, as variable rates fluctuate based on market conditions, providing potential savings. Fixed rates offer stability but may be higher. Homeowners should compare rates from different lenders and consider the impact of interest on their long-term financial obligations. Understanding these factors is essential when utilizing revolving credit for home-related expenses, ensuring a financially prudent decision in the ever-changing real estate landscape.