In the dynamic real estate market, short-term access equity offers investors flexible participation with partial ownership across diverse asset classes without long-term commitments. By understanding this strategy, investors can diversify portfolios, manage risks, capitalize on market fluctuations, and democratize real estate benefits. To maximize access, consider investing in affordable housing for low-to-middle-income households and partnering with community organizations focused on housing affordability. Navigating short-term investments requires balancing market volatility, property value dynamics, tenant turnover, local trends, regulatory changes, and a strategic approach to harness rewards while mitigating challenges.

“In today’s dynamic real estate market, understanding short-term or access equity is a game-changer. This article explores the potential of unlocking hidden values through temporary ownership, offering a comprehensive guide for investors and property enthusiasts alike. From strategies to maximize gains to navigating risks, we delve into the world of short-term real estate investments. Discover how savvy navigation can lead to significant returns in this ever-evolving landscape.”

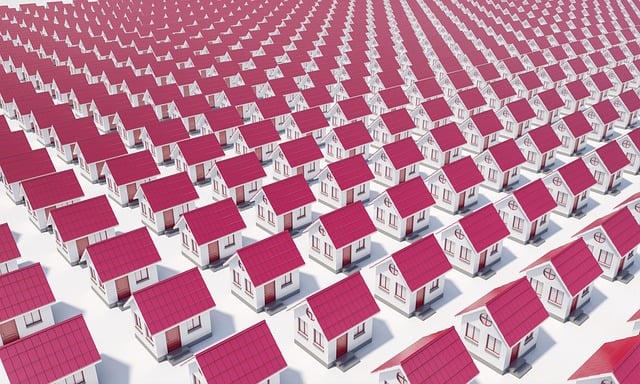

Unlocking Potential: Understanding Short-Term Real Estate Equity

In the dynamic realm of real estate, short-term or access equity represents a compelling opportunity for investors to participate in the market and unlock hidden potential. This strategy involves acquiring partial ownership of properties, offering a flexible entry point into the sector. By embracing this approach, investors can gain exposure to diverse asset classes, from residential to commercial properties, without the long-term commitment typically associated with traditional real estate investments.

Understanding short-term equity in real estate is key to navigating this lucrative space. It enables participants to diversify their portfolios, mitigate risks through partial ownership, and capitalize on market fluctuations. Moreover, it fosters inclusivity, allowing individuals to become stakeholders in properties they might otherwise only dream of owning, thereby democratizing access to the benefits and appreciation that real estate can offer.

Strategies for Maximizing Access Equity in the Property Market

To maximize access equity in the property market, individuals and investors alike should explore diverse strategies. One key approach is to diversify real estate investments across various geographic locations and asset classes. This reduces risk and allows for broader market exposure, ensuring that opportunities are not limited to a single area or type of property. Additionally, focusing on affordable housing segments can significantly enhance access equity. Investing in properties that cater to low-to-middle-income households not only contributes to societal inclusivity but also offers attractive returns in the long term, as these markets tend to be more resilient and have higher growth potential.

Another effective strategy is to partner with community organizations. Collaborating with local initiatives that aim to improve housing affordability and accessibility can provide valuable insights and opportunities. This might involve developing low-cost rental options or implementing programs that support first-time homebuyers. By integrating these partnerships into investment plans, real estate professionals can actively contribute to building more equitable communities while achieving financial goals.

Navigating Risks and Rewards: A Comprehensive Guide to Short-Term Real Estate Investments

Navigating Risks and Rewards involves a careful balance in the realm of short-term real estate investments. These ventures, often focused on quick flipping or short-lease properties, offer both tantalizing profits and significant perils. Investors must be adept at assessing market fluctuations, understanding property values’ intricate tapestry, and anticipating tenant turnover rates. A comprehensive guide is essential to unravelling these complexities.

By meticulously studying local real estate trends, analyzing comparable sales data, and factoring in repair costs and potential legal issues, investors can mitigate risks. Diversifying their portfolio across various asset types, locations, and investment strategies further strengthens their position. Equally vital is staying abreast of regulatory changes and economic shifts that could impact property values. This proactive approach ensures that the rewards outweigh the challenges, fostering a sustainable path in the dynamic world of real estate.