Homeowners can access a Home Equity Line of Credit (HELOC) to borrow against the equity in their real estate, providing flexible funds for renovations or debt consolidation with potentially lower interest rates than unsecured loans. As collateralized borrowing, HELOCs offer significant advantages like financial flexibility and conversion of real estate into liquid funds. However, homeowners must weigh risks like foreclosure if property values decline or financial difficulties arise, ensuring alignment with long-term goals and real estate investment strategy.

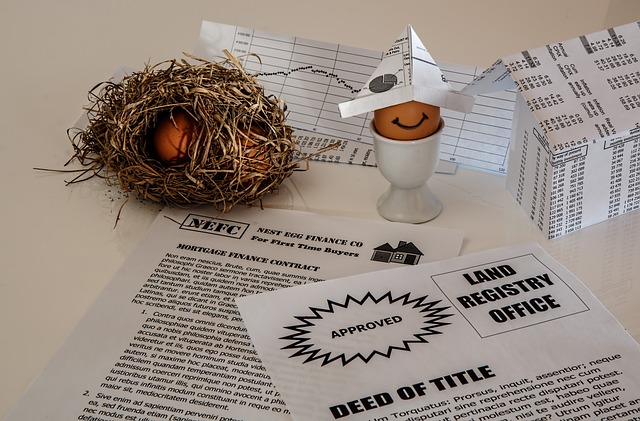

Considering a home equity line of credit (HELOC)? This financial tool allows real estate owners to borrow against their home’s value, providing access to cash for various needs. From home improvements to unexpected expenses, HELOCs offer flexible borrowing and potential tax benefits. In this guide, we’ll break down what a HELOC is, how it works, and explore the pros and cons for real estate owners looking to tap into their home’s equity.

What is a Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow money against the equity they’ve built up in their real estate investment. It functions similarly to a credit card, offering a line of credit with a revolving balance. The key difference lies in the collateral—the home itself serves as security for the loan. This means that if you fail to make your payments, the lender can initiate foreclosure proceedings to recover the outstanding debt.

HELOCs are popular among homeowners because they offer flexibility and potential tax benefits. You can use the borrowed funds for various purposes, from home renovations to debt consolidation or even unexpected expenses. The interest rate on a HELOC is often lower than that of other unsecured loans, making it an attractive option for those looking to access their home’s equity without completely selling it.

How Does Borrowing Against Home Equity Work?

Borrowing against home equity is a financial strategy that allows homeowners to access a portion of their property’s value, essentially converting their real estate investment into liquid funds. This process involves securing a loan against the equity built up in your house, which is determined by subtracting the outstanding mortgage balance from the current market value of the property. Once approved, borrowers can utilize this line of credit for various purposes, such as home renovations, debt consolidation, or even investing in other opportunities.

The process typically entails applying for a home equity line of credit (HELOC), where lenders assess your financial health and property’s appraised value to determine the available borrowing limit. Unlike traditional mortgages, HELOCs offer a revolving credit line, allowing borrowers to access funds as needed, repay, and reborrow throughout the agreed-upon period, often with a lower interest rate than other unsecured loans. This makes it an attractive option for those looking to leverage their real estate investment for short-term financial needs or long-term strategic planning.

Benefits and Considerations for Real Estate Owners

For real estate owners, borrowing against home equity offers a unique opportunity to access financial flexibility. This option allows homeowners to tap into the value they’ve built up in their properties, providing funds for various purposes such as home improvements, debt consolidation, or even investments. One significant advantage is the potential to enjoy lower interest rates compared to traditional loans, saving on borrowing costs over time. Additionally, these lines of credit can be a convenient and flexible financing solution, offering a revolving balance that adapts to an owner’s financial needs.

However, it’s crucial for real estate owners to carefully consider both the benefits and potential drawbacks. Borrowing against home equity involves risk; if property values decline or the borrower faces financial difficulties, they could face foreclosure. Moreover, these loans are typically secured by the homeowner’s primary residence, which can create a sense of financial exposure. It’s essential to assess one’s financial situation, future plans, and risk tolerance before deciding to borrow against home equity, ensuring it aligns with their long-term goals and real estate investment strategy.