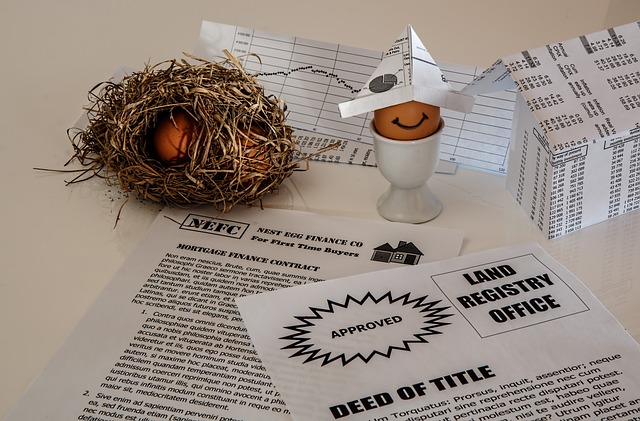

A Home Equity Line of Credit (HELOC) is a powerful financial tool for real estate owners, offering access to funds up to a predetermined limit secured by their home's equity. This flexible option provides lower interest rates compared to traditional loans and is ideal for long-term needs like retirement or home improvements. However, real estate investors must consider variable interest rates, repayment capacity, and explore alternative financing options to ensure this strategy aligns with their financial goals and investment plans.

“Enhance your real estate portfolio with a home equity line of credit (HELOC), a versatile financial tool. This strategy allows property owners to borrow against their home’s value, providing access to capital for various purposes. Whether it’s for home renovations, debt consolidation, or even investments, HELOC offers flexibility and potential tax benefits.

In this guide, we’ll explore how this process works, unravel the advantages and considerations for real estate owners, and help you make informed decisions regarding your property.”

What is a Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow money against the equity they’ve built up in their real estate investments. It functions similarly to a credit card, except the collateral is the home itself. This means you can access funds whenever you need them, up to a predetermined limit set by the lender, based on the current value of your property minus any outstanding mortgage balance.

HELOCs offer flexibility and convenience for real estate owners looking to manage cash flow or cover unexpected expenses. They often come with lower interest rates compared to traditional loans because the home serves as security. This makes them an attractive option for those who anticipate needing access to funds over a long period, such as during retirement or for home improvements that can increase the property’s value.

How Does Borrowing Against Home Equity Work?

Borrowing against home equity, a popular strategy in the real estate world, allows homeowners to tap into the value they’ve built up in their properties. This process involves using your home as collateral for a loan, providing access to substantial funds that can be used for various purposes. The key player here is a home equity line of credit (HELOC), which offers a revolving credit line secured by the equity in your house.

When you open a HELOC, the lender assesses your property’s value and establishes a line of credit up to a certain percentage of that value. You can then borrow money against this line as needed, typically through a debit or credit card linked to the account. The beauty of this method is its flexibility; you only pay interest on the borrowed amount, making it a potentially cost-effective option for short-term financial needs or even home improvements, given the tax benefits and potential for higher interest rates compared to other loans.

Benefits and Considerations for Real Estate Owners

For real estate owners, borrowing against home equity offers a unique financial opportunity. One of the key benefits is access to significant funds without the need for collateral beyond the owner’s property. This can be particularly advantageous during life stages where substantial expenses arise, such as funding home renovations, paying for education, or even starting a business. The line of credit provided through this process allows for flexibility in borrowing and repayment, catering to individual needs.

Considerations for real estate owners include understanding the interest rates attached to these loans, which can vary based on market conditions and credit history. Additionally, homeowners should be mindful of their financial obligations and ability to repay the borrowed amount over time without causing distress to their budget. It’s crucial to explore alternative financing options and thoroughly evaluate the long-term implications to ensure this borrowing solution aligns with their financial goals and real estate investment strategy.