In real estate lending, managing default risk is paramount for lenders and borrowers alike. Lenders assess borrower creditworthiness, income reliability, and property valuations to predict potential defaults, especially in volatile markets. Legal protections like collateral seizure, personal guarantees, and foreclosure empower lenders if borrowers default. Borrowers minimize risk through transparent financial practices, responsible borrowing, and maintaining appropriate loan-to-value ratios. Lenders employ strategies including accurate appraisals, credit checks, flexible terms, diversification, and market trend monitoring to mitigate risks.

In the dynamic landscape of real estate, understanding default risk is paramount for both borrowers and lenders. This article delves into the intricacies of protecting lenders when borrowers falter, focusing on key legal protections like collateral and guarantees. We explore strategies for mitigating risks, offering valuable insights for borrowers seeking financing and lenders aiming to secure their investments. By examining these measures, we aim to illuminate best practices in real estate lending.

Understanding Default Risk in Real Estate Lending

In the realm of real estate lending, understanding default risk is paramount for both lenders and borrowers. Default risk refers to the possibility that a borrower will fail to repay their loan as agreed upon, leading to potential financial losses for the lender. This risk is particularly heightened in the real estate sector due to the significant value of collateral involved and the potential fluctuations in property values.

Lenders assess default risk through various factors such as the borrower’s credit history, income stability, and the property’s market value. In a volatile real estate market, lenders may implement stricter lending standards or require additional assurances to mitigate the risk of default. By carefully evaluating these factors, lenders can protect their interests and ensure the stability of their real estate portfolios.

Legal Protections for Lenders: Collateral and Guarantees

In the event of a borrower’s default, lenders in the real estate sector have several legal protections at their disposal. One of the most common and effective strategies is the use of collateral. When a loan is secured with real property, such as a residential or commercial asset, the lender gains a lien on that property. This means if the borrower fails to repay the debt, the lender can initiate foreclosure proceedings to seize and sell the collateral to recover their losses.

Additionally, lenders often require guarantees from borrowers, which can be in the form of personal guarantees or business partnerships. These guarantees legally bind the guarantor to repay the loan if the primary borrower defaults. This adds an extra layer of security for lenders, especially in high-risk investments like commercial real estate deals. Such protections enable lenders to mitigate risks and ensure they have recourse when borrowers are unable to fulfill their financial obligations.

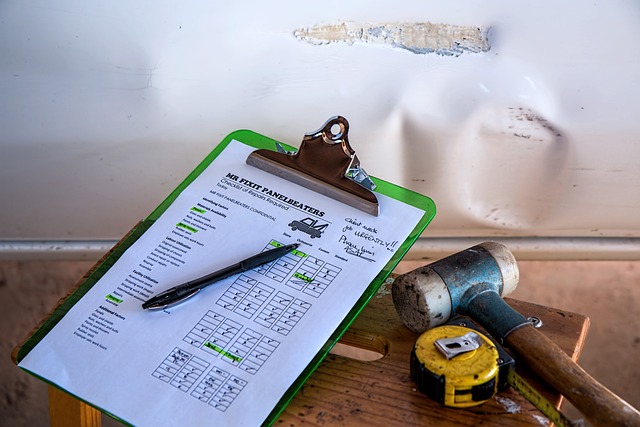

Mitigating Risks: Strategies for Borrowers and Lenders

When it comes to mitigating risks in real estate transactions, both borrowers and lenders play crucial roles. Borrowers can take proactive steps to minimize the chance of default by maintaining transparent financial records, ensuring steady employment, and keeping a buffer between their loan amount and their estimated property value. This involves responsible borrowing practices, such as avoiding excessive debt and maintaining a healthy cash flow to cover potential unexpected expenses.

Lenders, on the other hand, can implement robust risk management strategies. These include thorough property appraisals to accurately assess collateral values, comprehensive credit checks, and flexible loan terms tailored to borrowers’ capabilities. Additionally, diversifying their portfolio by lending across various property types and locations can spread risk effectively. Lenders should also remain vigilant about market trends and economic indicators that might signal potential defaults, enabling them to take timely corrective actions.