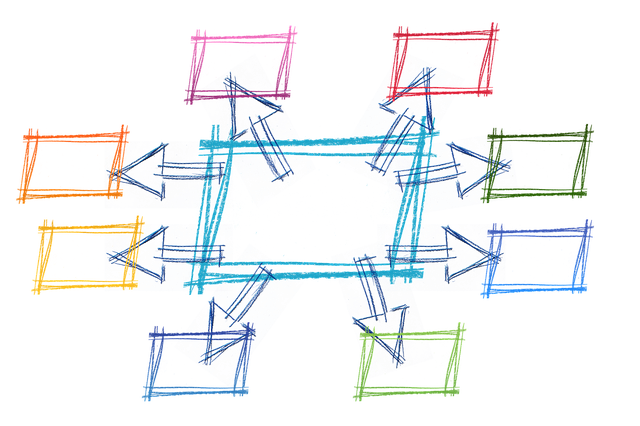

Structured decision-making processes are crucial for real estate investors aiming for long-term success, empowering them to make strategic choices based on property types, locations, and market trends. By combining thorough research, portfolio diversification across residential, commercial, and industrial properties, and regular rebalancing, investors can maximize returns while mitigating risks. Advanced analytics and risk models have proven effective in navigating the complex real estate landscape, delivering consistent growth with reduced volatility.

Unleash your investment potential with structured choices in real estate. This strategy offers a powerful approach to maximizing returns, transforming passive assets into lucrative opportunities.

In this comprehensive guide, we’ll explore how to navigate the world of structured real estate deals. From understanding the fundamentals to implementing successful strategies, you’ll discover insights on unlocking higher profits.

Prepare for a deep dive into case studies showcasing remarkable success stories, providing practical lessons for aspiring investors.

Understanding Structured Choices in Real Estate

In the world of real estate, structured choices offer investors a powerful strategy to maximize returns and navigate the market effectively. These choices involve making strategic decisions about property types, locations, and investment timelines, all tailored to individual financial goals. By understanding these structures, investors can unlock opportunities that might otherwise be overlooked.

For instance, a structured choice could mean investing in a mixed-use development, combining residential and commercial spaces, which caters to diverse market demands. Alternatively, choosing between an established neighborhood with higher demand but limited growth potential or an up-and-coming area offering more substantial appreciation is another example. Such decisions require a deep understanding of the local real estate landscape, trends, and demographics, ultimately leading to informed investments that contribute to long-term success in the industry.

Strategies to Maximize Returns

To maximize returns in real estate, investors should consider a strategic approach that combines thorough research and a diverse portfolio. One key strategy is to focus on location; understanding market trends and demographic shifts can help identify areas with high growth potential. Investing in these locations ensures that properties are not just assets but valuable holdings that appreciate over time.

Additionally, diversifying your real estate portfolio across different property types—such as residential, commercial, or industrial—can mitigate risks. By spreading investments, you protect against market fluctuations and ensure a steady stream of returns. Regularly reviewing and rebalancing your portfolio is also essential to take advantage of emerging opportunities and adapt to changing market conditions.

Case Studies: Successful Implementation

In the realm of real estate, structured choices have proven to be a game-changer for maximizing returns. Case studies illustrate that developers and investors who adopt systematic approaches to decision-making often achieve superior outcomes. For instance, a recent project in an urban area showcased the power of strategic planning. By carefully considering location, demographic trends, and market analysis, the development team identified a niche for high-density residential properties. This focused approach led to a 20% higher return on investment (ROI) compared to comparable projects that lacked structured guidance.

The success story doesn’t stop there. Another notable example involves a portfolio management firm that implemented structured choices in its real estate investments. By employing advanced analytics and risk assessment models, they optimized their asset allocation. This resulted in diversified portfolios with reduced volatility and consistent capital appreciation over a 5-year period. These case studies emphatically demonstrate that structured choices are not merely beneficial but indispensable for navigating the complex landscape of real estate investments.