Real estate investors and builders must thoroughly assess development sites before purchasing, focusing on physical attributes, historical use, environmental factors, local market dynamics, and zoning regulations. Conducting due diligence involves evaluating site conditions, consulting experts, understanding local laws, and analyzing financial aspects like market trends and comparable sales to ensure a sound investment in the competitive real estate market. Strategic planning through location feasibility checks, site inspections, and comprehensive analysis can maximize investment returns.

Before diving into the real estate market, especially for development projects, conducting thorough research is paramount. This article guides you through essential steps to ensure informed decisions when purchasing development sites. We’ll explore key factors in assessing a site’s potential, from understanding local zoning regulations and infrastructure capabilities to analyzing market trends and environmental considerations. By mastering these skills, you’ll maximize your investment returns and navigate the real estate landscape with confidence.

Understanding Development Potential: What to Look For in a Site

When considering a development site, understanding its potential is crucial for any real estate investor or builder. The first step is to assess the physical attributes of the land—its size, topography, zoning regulations, and proximity to essential services like water, electricity, and transportation networks. These factors will dictate what kind of development can be undertaken and its overall feasibility.

Look for signs of historical use that can provide insights into the site’s capacity for new construction. Evidence of past developments, along with any environmental considerations or potential challenges, should be thoroughly examined. Additionally, understanding the local market dynamics—including demand for housing or commercial spaces—is vital to gauge the potential return on investment. This process involves researching comparable sales, rental rates, and future growth projections to make informed decisions about a site’s development potential in the real estate market.

Conducting Thorough Due Diligence Before Buying

Before purchasing a development site, conducting thorough due diligence is paramount in the real estate realm. This involves an exhaustive review of various factors that could impact your investment. It’s crucial to assess the site’s physical condition, including any potential environmental issues or structural concerns. Consult professionals who can inspect and provide insights into the land’s suitability for development, especially if it’s a former industrial or commercial space.

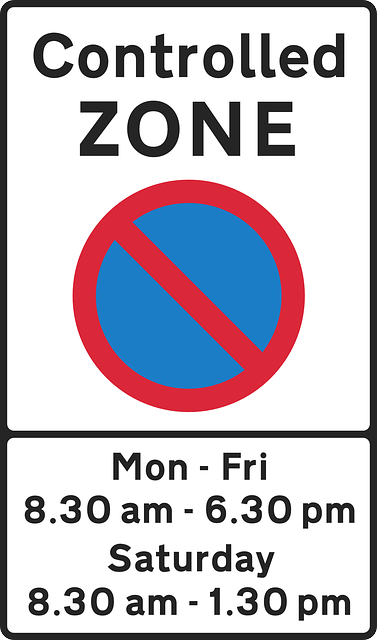

Additionally, investigate local zoning regulations and permits required for your intended use. Check with relevant authorities to ensure the property aligns with current guidelines. Financial aspects also demand meticulous attention; analyze market trends, comparable sales, and potential return on investment. Conducting this level of due diligence empowers informed decision-making in what can be a complex real estate landscape.

Maximizing Your Investment: Tips for Evaluating a Development Site's Feasibility

When considering a development site, it’s crucial to approach the purchase with a strategic eye for investment. Maximizing your return involves a thorough evaluation of the property’s feasibility. Begin by assessing the location; is it zoned for the intended use? Check local planning guidelines and building codes to ensure your development plans align with regulations. The surrounding area’s amenities, infrastructure, and growth potential are also vital indicators—a vibrant real estate market suggests higher demand for any proposed developments.

Next, conduct a thorough site inspection. Look beyond the surface; check for any environmental concerns, existing structures, or hidden issues that could impact development. Evaluate accessibility and consider the costs associated with connecting to essential services like water, electricity, and sewage. Analyzing comparable sales in the area can provide insights into market values and potential resale opportunities. Remember, a well-informed decision at this stage could turn a promising real estate investment into a lucrative success.