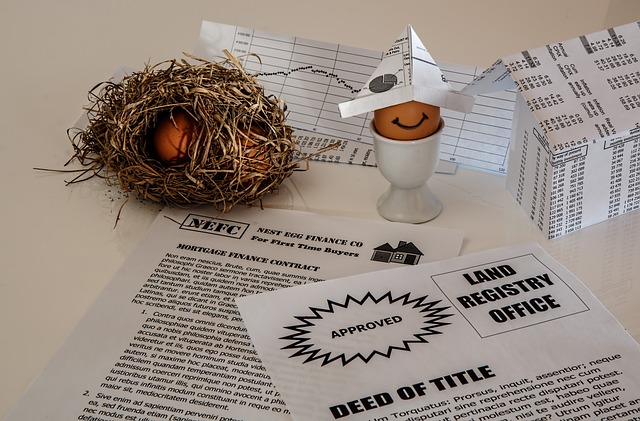

In real estate, "interest-only financing" charges interest only on borrowed amounts, lowering initial payments for borrowers and attracting investors seeking cash flow. This model benefits both parties through cost-effective financing, transparency, and flexible repayment options. Lenders can enhance revenue by setting competitive rates, communicating clearly, and using automated tracking tools, fostering a mutually beneficial partnership in the real estate market.

In the competitive real estate market, understanding interest calculation methods is crucial for both lenders and borrowers. This article delves into a specific yet powerful strategy: charging interest only on the utilized amount in real estate loans. We explore the benefits of this approach, from enhanced financial flexibility to reduced borrowing costs. Real estate lenders can navigate implementation challenges by adopting best practices, ensuring sustainable and mutually beneficial transactions.

Understanding Interest Calculation in Real Estate Loans

In real estate transactions, interest calculation plays a pivotal role in determining the overall cost of borrowing for buyers. Unlike some loan types where interest is calculated on the entire principal sum, real estate loans often charge interest only on the utilized amount. This approach ensures that borrowers are not burdened with excess interest payments when they haven’t yet accessed the full loan funds. It’s akin to paying for the resources you’ve actually consumed, rather than a fixed rate based on a larger pool of money.

This method becomes especially beneficial in scenarios where loans are structured for specific needs, such as construction or renovation projects that may not utilize the entire funds at once. Lenders and borrowers both gain from this transparency; lenders offer competitive rates knowing the risk is mitigated, while borrowers save on interest expenses by paying only what they’ve utilized. This practice aligns with the dynamic nature of real estate deals, fostering a more flexible and cost-effective financing environment for all parties involved.

Benefits of Charging Interest Only on Utilized Amount

Charging interest only on the utilized amount in real estate transactions offers several advantages for both lenders and borrowers. This approach, often referred to as “interest-only financing,” allows borrowers to pay a lower monthly payment initially, making it more affordable. Instead of paying down both the principal and interest each month, borrowers focus solely on covering the interest expense, which can be particularly beneficial during the initial years of a loan when most of the payment goes towards interest.

This strategy provides flexibility as it enables borrowers to allocate their funds differently. They can choose to invest the difference between what they would have paid in full payments and their actual living expenses. For real estate investors, this model offers an opportunity to generate cash flow by potentially reinvesting the savings from lower monthly payments into other lucrative opportunities.

Implementation and Best Practices for Real Estate Lenders

Implementing an interest charging model based on the utilized amount is a strategic move for real estate lenders to optimize their revenue streams while promoting responsible borrowing. This approach ensures that lenders are compensated for the risk and resources committed, with the interest rate directly proportional to the borrowed funds actually in use.

Best practices for real estate lenders include setting transparent and competitive rates, clearly communicating the terms to borrowers, and offering flexible repayment options tailored to various down payment scenarios. Lenders should also consider implementing automated systems to accurately track and calculate interest on a daily or monthly basis, ensuring fairness and consistency in charging. This method fosters trust between lenders and borrowers, encourages responsible lending, and positions real estate financing as a mutually beneficial partnership.