Flexibility Meets Security: Conventional Mortgages for Real Estate Investors

In the Real Estate sector, conventional mortgages serve as a key financing option, offered by privat…….

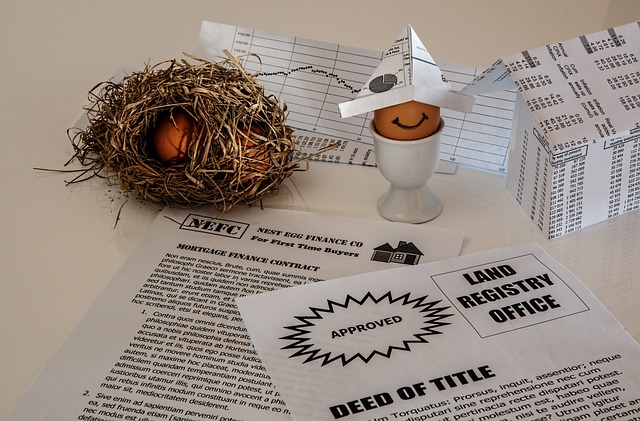

In today’s complex financial environment, understanding mortgage types is more crucial than ever for both individuals seeking homeownership and investors looking to diversify their portfolios. A mortgage type refers to the specific structure and terms of a loan used to purchase or secure a property, with each variant offering unique benefits and considerations. This comprehensive guide aims to demystify the world of mortgage types, exploring their historical evolution, global impact, economic implications, technological innovations, regulatory frameworks, challenges, and future prospects. By delving into these aspects, readers will gain valuable insights into how mortgages have shaped the real estate market and continue to influence personal finance worldwide.

At its core, a mortgage is a type of loan used primarily for purchasing or securing real estate. Mortgage types differ based on various factors, including the lender (e.g., banks, credit unions), the borrower’s creditworthiness, the property type, and repayment terms. The primary components of a mortgage include:

Mortgages have a rich history dating back to ancient civilizations. In early societies, land ownership was often tied to social status and wealth. As trade and commerce grew, so did the need for more complex financial mechanisms to facilitate large-scale property transactions. The modern mortgage as we know it today has evolved significantly over centuries:

Mortgage types play a pivotal role in various economic sectors:

Mortgage types have left a profound mark on the global financial scene, with variations tailored to suit diverse cultural, economic, and legal contexts:

Several trends shape the global mortgage landscape:

| Trend | Description | Impact |

|---|---|---|

| Digital Transformation | The rise of online lenders, mobile banking apps, and digital closing platforms is revolutionizing how mortgages are procured and managed. | Enhances accessibility, streamlines processes, reduces costs for borrowers and lenders. |

| Low-Interest Rates | Many central banks have implemented accommodative monetary policies, leading to historically low-interest rates, making borrowing more affordable. | Stimulates housing demand, encourages investment in real estate. |

| Sustainability Focus | There is a growing emphasis on environmentally friendly mortgages, with lenders offering green loans for energy-efficient properties. | Promotes sustainable building practices, supports the transition to renewable energy sources. |

| Alternative Lending | Non-traditional lenders, including peer-to-peer (P2P) platforms and fintech companies, are gaining traction, providing unique mortgage options. | Offers flexibility, caters to underserved borrowers, challenges traditional banking models. |

Mortgage types significantly influence the dynamics of the real estate market:

Mortgages are often packaged and sold as investments:

The digital age has brought about significant disruptions in the mortgage industry:

Digital lending offers several advantages:

However, challenges include:

Mortgage types are subject to extensive regulations aimed at protecting borrowers, promoting transparency, and maintaining stability in the financial system:

Regulatory approaches vary across jurisdictions:

Mortgage types often face several challenges and considerations:

Several strategies can help overcome these challenges:

The mortgage market continues to evolve, driven by technological advancements, regulatory reforms, and changing consumer needs. As we navigate an increasingly digital landscape, it is crucial to strike a balance between innovation and regulation to ensure a stable, transparent, and accessible mortgage ecosystem. By leveraging technology, adopting robust regulatory frameworks, and addressing affordability concerns, the mortgage industry can support sustainable economic growth while protecting borrowers and maintaining financial stability.

In the Real Estate sector, conventional mortgages serve as a key financing option, offered by privat…….

In the ever-changing real estate market, adjustable rates play a pivotal role for buyers and investo…….

In real estate, adjustable rates significantly impact market dynamics and consumer choices, with Adj…….

In the competitive real estate market, fixed-rate mortgages offer buyers and investors a stable opti…….

In today’s dynamic real estate market, understanding fixed-rate mortgages is a game-changer for aspi…….

In real estate, conventional mortgages offer diverse loan types (fixed-rate, adjustable-rate) and te…….

FHA financing is a powerful tool for first-time homebuyers in the real estate market, offering low d…….

First-time homebuyers can navigate the real estate market with ease using Federal Housing Administra…….

In the volatile real estate market, fixed-rate mortgages offer borrowers stability and predictabilit…….

In the real estate market, Adjustable-Rate Mortgages (ARMs) offer lower initial rates but periodical…….