Understanding lender thresholds, like loan-to-value (LTV) ratios, is crucial in real estate for buyers and sellers. Lower LTV ratios secure better loan terms. Below-threshold loans provide accessible funding for limited credit borrowers, while non-conforming mortgages finance high-value properties. Both offer opportunities but come with risks, requiring a balanced approach based on market conditions.

In the dynamic landscape of real estate, understanding lender threshold guidelines is crucial for both borrowers and lenders. This article delves into the intricacies of these thresholds, shedding light on what below-threshold loans entail and their associated benefits and risks. By exploring these concepts, we aim to equip readers with knowledge necessary to navigate the complex world of non-conforming mortgages, empowering informed decisions in the real estate market.

Understanding Lender Thresholds in Real Estate

In the vibrant world of real estate, understanding lender thresholds is a game-changer for both buyers and sellers. These thresholds, also known as loan-to-value (LTV) ratios, represent the maximum amount a lender is willing to offer as a loan against a property’s value. It’s a crucial factor in determining an individual’s ability to purchase a home or invest in real estate projects. Lenders carefully assess these ratios to mitigate risk and ensure responsible lending practices.

When considering a real estate transaction, staying below the lender threshold guidelines can open doors to favorable borrowing terms. This often means securing a larger down payment, which can result in lower interest rates and more manageable monthly payments. For many, it’s a strategic approach to building wealth in the long term while avoiding excessive debt. Understanding these thresholds is essential for navigating the real estate landscape with confidence.

What Are Below-Threshold Loans?

Below-threshold loans, often referred to as microloans or small business loans, are financial products specifically designed for borrowers who cannot meet the eligibility criteria for traditional bank financing due to low credit scores, lack of collateral, or limited business history. These loans operate within a predefined threshold set by lenders, typically targeting individuals and businesses in the real estate sector looking for capital to start or expand their operations.

In the context of real estate, below-threshold lending provides accessible funding options for first-time investors, entrepreneurs, or small property developers who may struggle to secure conventional loans from banks. Such loans often come with simpler application processes, faster approval times, and flexible repayment terms, making them an attractive alternative for those operating within the real estate market but lacking substantial financial reserves or credit history.

Benefits and Risks of Non-Conforming Mortgages

Non-conforming mortgages, often referred to as jumbo loans in the real estate world, offer unique opportunities for both lenders and borrowers. One significant advantage is their ability to finance larger properties that traditional mortgages may not cover. This is particularly beneficial in high-value real estate markets where property prices exceed standard loan limits. Such mortgages allow individuals to secure funding for dream homes or investment properties that might otherwise be out of reach.

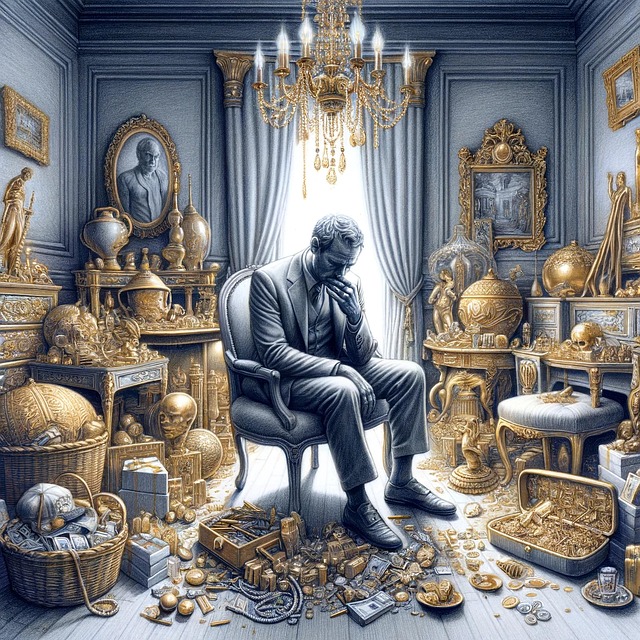

However, there are risks associated with these non-conforming loans. They typically carry higher interest rates and require more stringent underwriting criteria due to their larger size. Borrowers must demonstrate stronger financial capabilities and creditworthiness to qualify. Additionally, if market conditions change, these mortgages may become more expensive or difficult to repay, leading to potential financial strain on borrowers. Thus, a thorough understanding of both the benefits and risks is crucial before delving into non-conforming mortgage options in the competitive real estate sector.