Real estate professionals are leveraging data analysis to make informed decisions in a competitive market. By examining demographics, historical transactions, and market trends, they gain insights into high-growth areas, predict price movements, and adapt strategies. Adaptive pricing based on real-time data maximizes sales and strengthens client trust. Advanced predictive analytics help identify potential locations for mixed-use developments by forecasting demand through employment rates, population density, and infrastructure development. This strategic approach ensures optimal returns by staying ahead of market trends.

In today’s data-driven world, real estate professionals must adapt their strategies based on insights from market trends and analytics. This article explores three key areas where data revolutionizes the industry. Understanding data-driven real estate trends empowers informed decisions. Implementing adaptive pricing strategies leverages market fluctuations for optimal returns. Predictive analytics transforms location selection by forecasting future developments. By embracing these approaches, real estate experts can navigate the market more effectively and capitalize on emerging opportunities.

Understanding Data-Driven Real Estate Trends

In today’s digital era, real estate is experiencing a significant transformation as data becomes an invaluable tool for understanding market trends. By analyzing vast datasets, from demographic shifts to historical property sales, professionals can uncover insights that were once hidden. These data-driven trends offer a fresh perspective on where the industry is headed, allowing agents and investors to make informed decisions. For instance, identifying emerging neighborhoods with high growth potential or predicting price fluctuations based on seasonal patterns can give an edge in a competitive market.

Understanding these trends enables participants in the real estate sector to adapt their strategies accordingly. Whether it’s tailoring marketing approaches to specific demographics or adjusting investment portfolios to capitalize on upcoming developments, data provides a competitive advantage. It empowers individuals to make strategic moves, stay ahead of the curve, and ultimately succeed in an ever-evolving real estate landscape.

Implementing Adaptive Pricing Strategies

In the competitive landscape of real estate, implementing adaptive pricing strategies is a game-changer. By leveraging data insights, real estate professionals can adjust their pricing models in real-time to align with market trends and consumer behavior. This approach ensures that properties are priced optimally, attracting more potential buyers and selling faster.

For instance, analyzing historical sales data, current market conditions, and demographic shifts can help determine the right price point for a property. Adaptive pricing strategies also enable agents to quickly respond to changes in demand, seasonality, or even specific neighborhood developments, giving them a competitive edge. This dynamic pricing method not only enhances sales performance but also fosters trust between agents and clients by demonstrating a data-driven, transparent approach.

Utilizing Predictive Analytics for Location Selection

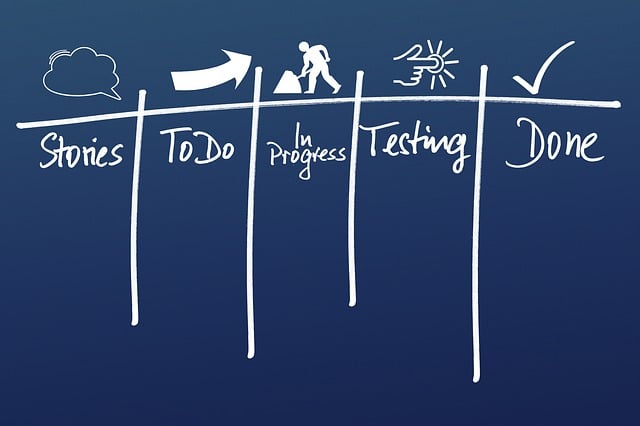

In today’s data-driven world, real estate professionals are leveraging predictive analytics to gain a competitive edge. By analyzing historical trends, market patterns, and demographic shifts, these advanced algorithms can pinpoint areas with high growth potential. This involves scrutinizing factors like employment rates, population density, and infrastructure development to forecast demand and identify optimal locations for new investments or developments.

For instance, an investment firm might use predictive models to determine the best cities or neighborhoods for constructing mixed-use complexes. By understanding where people are moving, their spending habits, and community preferences, developers can make informed decisions about site selection. This strategic approach ensures that real estate ventures are not just built on current demand but also anticipate future market trends, ultimately maximizing returns and staying ahead of the competition.