Currency exchange rates significantly impact global real estate markets, affecting affordability and profitability for international investors. Exchange rate fluctuations lead to property value changes and market trends, with stronger home currencies potentially deterring foreign investment and weaker local currencies attracting buyers seeking affordable options. Navigating these dynamics requires diversification, staying informed about global events, tracking in real-time, and employing hedging techniques like forward contracts or options to manage risks effectively.

In the dynamic world of real estate, understanding currency exchange rates is paramount for investors navigating global markets. This article delves into the significant impacts of fluctuating exchange rates on property values and market trends. We explore strategies to mitigate risks and capitalize on opportunities presented by these global fluctuations. By comprehending the intricate relationship between currencies and real estate, investors can make informed decisions in today’s interconnected world.

Understanding Currency Exchange Rates in Real Estate

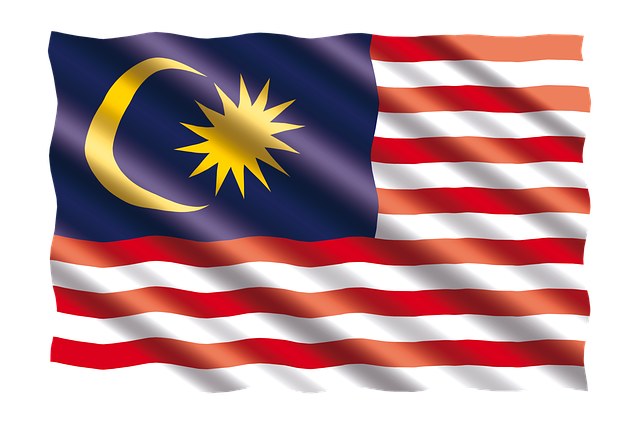

Currency exchange rates play a significant role in the global real estate market, especially for international investors and properties located across different countries. Understanding these rates is crucial for anyone navigating the complex world of Real Estate. Exchange rates can impact the affordability and profitability of property investments. When a currency strengthens, the purchasing power of investors from that currency increases, potentially making overseas properties more accessible and attractive.

For instance, if an investor from a country with a weaker currency seeks to purchase a property in a stronger economy, they may need to spend less of their home currency to secure the deal. Conversely, depreciation can make international investments costlier over time. Real Estate professionals must stay informed about exchange rate trends to advise clients effectively and ensure transactions remain beneficial, especially when dealing with cross-border property purchases or sales.

Impact on Property Values and Market Trends

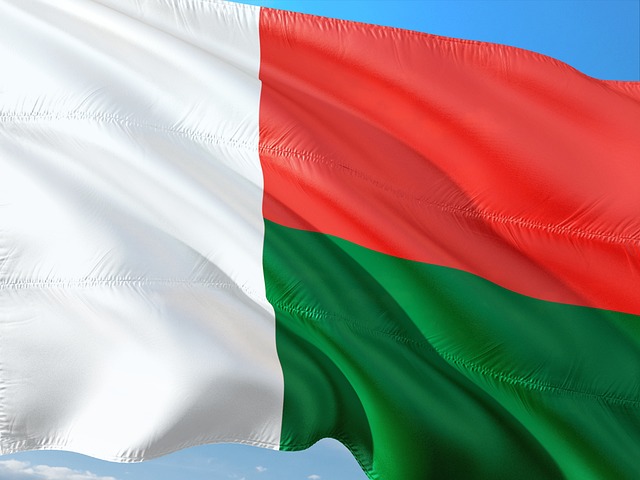

Exchange rate fluctuations can significantly impact real estate markets, affecting both property values and market trends globally. When currencies devalue or appreciate relative to each other, it influences the cost of international property purchases. For instance, a stronger home currency may make foreign properties more expensive for investors from countries with weaker currencies, potentially slowing down investment in those regions. Conversely, a depreciating local currency could attract foreign buyers seeking more affordable real estate options, leading to increased demand and price rises.

These exchange rate dynamics can create uncertain market conditions. Rapid changes might cause volatility in property prices, affecting both residential and commercial real estate sectors. Investors often monitor currency movements to time their purchases or sales strategically. Moreover, the impact extends beyond cross-border transactions; local real estate markets can experience shifts in pricing and demand due to the ripple effects of global exchange rate trends.

Strategies for Navigating Global Fluctuations in RE Investments

Navigating global currency exchange rate fluctuations is a skill every real estate investor must master in today’s interconnected world. With investments often spanning international borders, understanding and mitigating these risks are essential for success. One key strategy involves diversifying portfolios across different currencies to spread risk. By holding properties or investment vehicles in multiple countries, investors can protect themselves from severe swings in any single market.

Additionally, staying informed about economic indicators and political events globally is crucial. Regularly monitoring exchange rates and news can help investors anticipate changes and make timely decisions. Utilizing financial tools that provide real-time data on currency movements is beneficial. Moreover, hedging strategies, such as forward contracts or options, offer a way to lock in exchange rates and protect investments from potential losses during periods of volatility.