Modified Gross Splits (MGS) in real estate revolutionize property management by redistributing revenues and expenses among tenants, enhancing transparency and landlord predictability. This new model optimizes operations, improves tenant satisfaction, and empowers managers to focus on strategic initiatives, creating a more dynamic real estate experience while simplifying accounting and financial control. However, successful implementation requires clear communication and sophisticated accounting practices to manage complexities and avoid disputes.

In today’s dynamic real estate landscape, modified gross splits are transforming property management. This innovative approach shifts traditional responsibilities, offering both benefits and challenges for stakeholders. Understanding this concept is crucial for investors and managers alike, as it redefines how revenue and expenses are allocated, enhancing operational efficiency and profitability in the long run. Dive into this comprehensive guide to unravel the intricacies of modified gross splits in real estate.

Understanding Modified Gross Splits in Real Estate

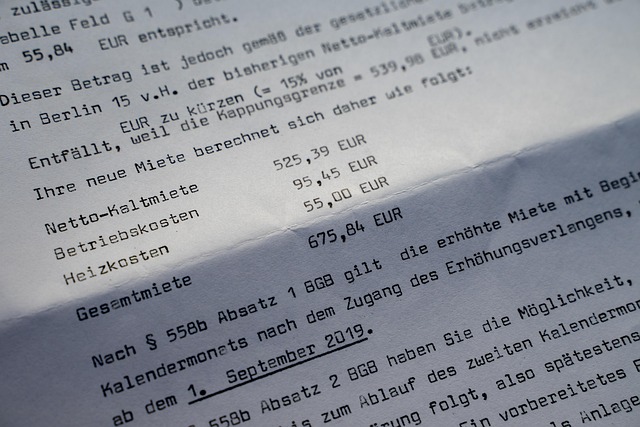

In the dynamic world of real estate, understanding Modified Gross Splits (MGS) is essential for investors and property managers alike. MGS is a financial distribution model that allocates expenses and revenues among tenants in a multi-tenant property. Unlike traditional gross leases, where the landlord bears most costs, MGS requires tenants to contribute to certain operational expenses based on their occupancy or square footage.

This innovative approach simplifies expense management by shifting some responsibilities to tenants while providing landlords with increased predictability in cash flow. By clearly defining each party’s financial roles and responsibilities, MGS fosters transparency and can lead to more efficient operations within the property. In essence, it’s a strategic tool that enhances the overall Real Estate investment experience.

Key Responsibilities Shifting in Property Management

In the realm of real estate, property management has witnessed a significant evolution with the advent of modified gross splits. This novel approach shifts key responsibilities, streamlining operations and enhancing efficiency. Traditionally, property managers handled various tasks, from tenant relations to financial oversight and maintenance coordination. However, with the new model, responsibilities are more precisely defined and distributed.

Tenants now benefit from enhanced communication and faster issue resolution as specific teams take the lead on different aspects of property management. Financial duties are meticulously separated, ensuring transparency and accurate accounting. This structured shift not only improves tenant satisfaction but also allows property managers to focus on strategic initiatives, fostering a more dynamic and responsive real estate experience.

Benefits and Challenges of This New Approach

The modified gross split in real estate offers a fresh perspective on responsibility distribution, presenting both advantages and potential hurdles. One of its key benefits is the improved financial clarity it brings for property owners. By separating expenses and revenues more precisely, landlords can gain better control over their investments, enabling them to make more informed decisions regarding tenants and maintenance. This approach simplifies accounting processes, making it easier to track income and expenses associated with individual units or blocks within a property.

However, challenges arise when implementing this strategy. Effective communication becomes paramount among all stakeholders—landlords, tenants, and management teams. Misunderstandings could lead to disputes over financial responsibilities. Additionally, the complexity of the split may require sophisticated accounting practices, which could be a significant learning curve for some. Balancing the benefits of enhanced transparency with these challenges is essential to ensure a successful transition to the modified gross split method in real estate.