Real estate flexibility offers cost savings and adaptability for changing life situations, empowering individuals to prioritize experiences over traditional ownership's stability, historical value appreciation, and strategic planning benefits. Balancing flexibility with ownership provides optimal strategies for diverse market requirements, catering to modern lifestyles while ensuring investment growth and income streams.

In the dynamic world of real estate, understanding the balance between flexibility and ownership is key. This article explores the unparalleled conveniences of flexibility in terms of relocating, customizing spaces, and short-term investments. However, ownership offers stability, long-term financial gains, and a sense of community. We delve into how combining these benefits can create an attractive middle ground for modern buyers. Discover the pros and cons to make informed decisions tailored to your lifestyle and investment goals in real estate.

Flexibility Offers Unmatched Conveniences in Real Estate

In the realm of real estate, flexibility offers unmatched conveniences that traditional ownership models often can’t match. The ability to rent or leverage flexible lease agreements allows occupants to adapt swiftly to life’s changing circumstances, be it a sudden job shift, desire for travel, or need to downsize. This agility is particularly appealing in today’s dynamic market where securing long-term financing and committing to a single property might not be feasible for everyone.

Flexibility also translates into cost savings by eliminating the burden of maintenance, repairs, and property taxes, which are typically the responsibility of homeowners but can be negotiated or waived in flexible arrangements. This freedom enables occupants to allocate their resources more effectively, potentially investing in experiences or other assets that align better with their priorities.

Ownership Brings Stability and Long-Term Value

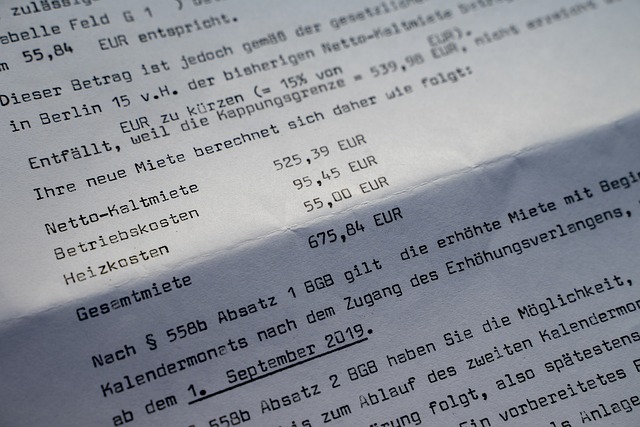

In the realm of real estate, ownership offers a sense of stability that is hard to replicate in other forms of investment. When individuals or entities own property, they have control over its use and can make decisions that align with their long-term goals. This predictability allows for strategic planning, whether it’s developing the land for residential or commercial purposes, ensuring a steady stream of income, or preserving a valuable asset for future generations.

Compared to renting or temporary arrangements, ownership provides a stable foundation for personal and financial growth. Real estate values have historically shown appreciation over time, offering potential for significant returns on investment. This long-term value is a key advantage that encourages smart planning, fosters community development, and contributes to a robust real estate market.

Balancing Act: Combining Flexibility and Ownership Benefits

In the realm of real estate, achieving a harmonious balance between flexibility and ownership benefits is akin to mastering a delicate dance. On one hand, flexibility offers tenants the freedom to adapt their living or working spaces to ever-changing needs, be it expanding operations or reorganizing interior layouts. This dynamic approach allows for agility in market fluctuations and caters to modern lifestyles characterized by constant evolution.

On the other hand, traditional ownership provides stability and long-term advantages. It grants unrestricted control over one’s property, enabling substantial investment growth over time. For investors, owning real estate offers a steady income stream through rentals or property appreciation. However, it requires significant upfront capital and commitment, which might not be feasible for all, especially in today’s fast-paced world where adaptability is key. Thus, the ideal scenario involves merging these elements—a flexible lease with ownership perks—to cater to diverse needs while ensuring a robust real estate strategy.