Before setting long-term financial goals, assess your current real estate position: net worth, debts, and cash flow to understand your ability to invest or purchase property. Visualize personal dreams like owning a dream home or retiring comfortably to guide decisions. Explore real estate investments for diversification, appreciation, and income. Stay informed about market trends to make sound decisions for enhanced financial stability.

Looking to secure your financial future? Achieving long-term stability requires strategic planning, starting with a thorough assessment of your current financial position. Define your aspirations—what does success look like to you? Once clear, explore real estate investment strategies as a powerful tool for building wealth and independence. Discover how property can anchor your financial tapestry, offering both income and protection against market volatility.

Assess Your Current Financial Position

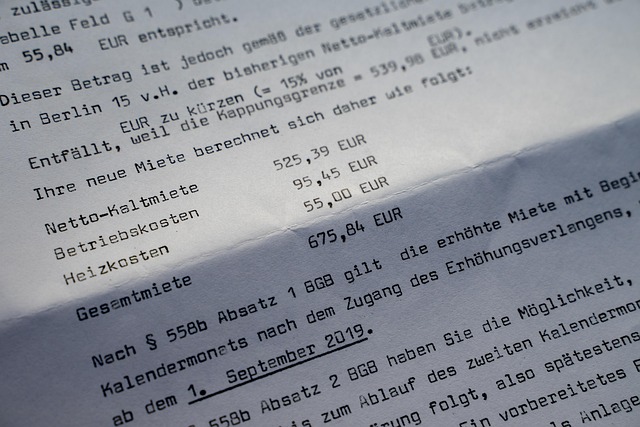

Before setting long-term financial stability goals, it’s crucial to assess your current position in the market, especially within the realm of real estate. This involves evaluating your existing assets, debts, and cash flow to get a clear picture of where you stand financially. By understanding your net worth and debt-to-income ratio, you can identify areas for improvement and make informed decisions about investments or purchases that will contribute to your future financial security.

For instance, if you’re a first-time homebuyer, assessing your financial position might involve saving for a down payment, researching mortgage options, and exploring potential property values in your desired location. This process ensures that your long-term goals are realistic, achievable, and aligned with your current abilities to navigate the real estate market effectively.

Define Long-Term Goals and Dreams

Long-term financial stability goals are shaped by our dreams and aspirations for the future. They represent the milestone moments we strive for, whether it’s buying a dream home in a desirable Real Estate location or planning for retirement with peace of mind. Defining these goals is the first step towards achieving them; it involves visualizing what success looks like personally and financially.

Take time to reflect on your desires and aspirations beyond immediate financial needs. Do you imagine yourself as a proud homeowner, enjoying the fruits of your labor through property investments? Or do you envision a comfortable retirement, free from monetary worries? Clarifying these long-term visions will guide your decisions and actions in building a robust financial foundation.

Explore Real Estate Investment Strategies for Stability

Exploring real estate investment strategies can be a powerful move towards long-term financial stability. Diversifying your portfolio with property offers unique advantages, such as leveraging appreciation over time and generating steady income through rent. With careful planning, investing in real estate can serve as a solid foundation for retirement or a future financial cushion.

Consider different approaches like buying rental properties, flipping houses for profit, or even investing in Real Estate Investment Trusts (REITs). Each strategy presents its own set of opportunities and risks, allowing you to tailor your investment to your financial goals and risk tolerance. By understanding the real estate market and staying informed about trends, you can make informed decisions that contribute to your overall financial stability.