Real estate savers balance immediate expenses like taxes and maintenance against potential long-term gains from property value growth and rental income. Strategic planning, diversification, market research, and networking are key to maximizing savings while effectively managing responsibilities in today's digital real estate market. Patience is crucial for longer-term holdings allowing properties to appreciate significantly.

In today’s competitive real estate market, balancing responsibilities and savings is a delicate act. This article explores the intricate dance between managing financial obligations and maximizing investments in property. We delve into strategies that help prioritize costs and benefits, ensuring responsible saving without compromising crucial commitments. Discover key insights on navigating this labyrinthine path to optimize your real estate journey and achieve long-term financial goals.

Balancing Act: Responsibilities vs Savings in Real Estate

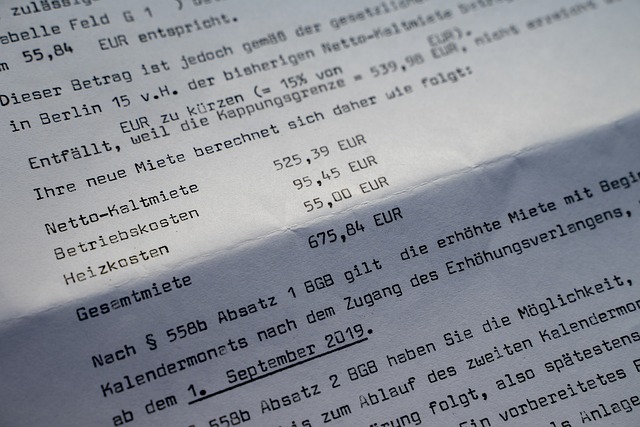

In the realm of real estate, balancing responsibilities and savings is a delicate dance. Property owners often find themselves caught between the demand for maintaining their assets and the desire to maximize financial returns. This balancing act involves a series of strategic decisions that can make or break the success of an investment. One side of the scale includes regular expenses such as property taxes, insurance, maintenance, and repairs—all necessary to keep the asset in top condition. On the other side, there are potential savings through long-term increases in property value, rental income from tenants, or the sale of the property at a higher price in the future.

Navigating this equilibrium requires careful consideration. For instance, prioritizing routine upkeep can prevent significant repairs down the line, thereby preserving capital. Conversely, investing in improvements like a new roof or renovation may initially drain resources but could attract buyers or command higher rents upon sale. In the world of real estate, understanding these dynamics is crucial for maximizing savings while meeting obligations.

Prioritizing Investments: Weighing Costs and Benefits

When prioritizing investments in real estate, it’s crucial to weigh the costs against the potential savings. Each property comes with a unique set of expenses, from maintenance and taxes to insurance and repairs. By meticulously evaluating these costs, investors can make informed decisions that align with their financial goals.

The benefits of real estate investments, such as rental income or property appreciation, must be carefully balanced against these expenses. This process involves not just looking at the immediate financial picture but also considering long-term gains. Savvy investors recognize that strategic planning and adaptability are key to maximizing savings while managing responsibilities effectively.

Maximize Returns: Strategies for Responsible Saving

In today’s digital era, where opportunities abound, maximizing returns from savings is a strategic art. For those considering investments, real estate stands out as a game-changer. It offers not just financial gains but also a tangible asset that can be passed down through generations. Strategies for responsible saving in this realm include diversifying your portfolio by investing in different property types and locations to mitigate risk. Additionally, leveraging technology for efficient property management enhances returns while minimizing expenses.

Regular market research and staying informed about trends enable savvy savers to make informed decisions. Building a robust network of industry professionals—from agents to lawyers—facilitates smooth transactions, ensuring every move contributes to maximizing savings. Remember that patience is key; holding properties for longer periods allows for significant appreciation, providing a substantial financial cushion.