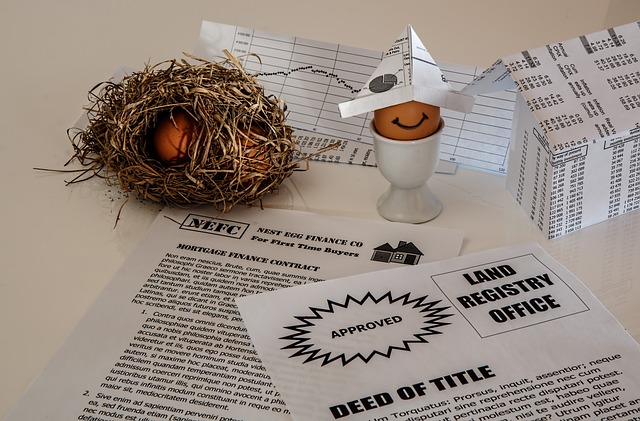

In real estate, "interest-only" mortgages charge interest on the borrowed amount used, not the total loan value, offering borrowers initial financial flexibility and lower costs. This approach encourages responsible borrowing, reduces lender risk, and can be automated for transparent tracking, streamlining the real estate process.

In real estate, understanding interest calculation and charging interest only on the utilized amount can significantly impact financial strategies. This article delves into the intricacies of this approach, exploring its benefits—from enhanced cash flow to improved investment management. We discuss how this method simplifies interest collection, reduces costs, and promotes efficient financial planning for both lenders and borrowers in the dynamic real estate market.

Understanding Interest Calculation in Real Estate

In the realm of real estate, understanding interest calculation is paramount for both lenders and borrowers. When it comes to mortgages or loans for purchasing property, interest is charged based on the utilized amount, not the total loan value. This approach, often referred to as “interest-only” or “partial interest,” ensures that borrowers pay a more manageable sum initially, allowing them to gradually build equity in their properties over time.

This strategy offers several advantages. For starters, it provides financial flexibility during the early years of a mortgage, enabling homeowners to allocate resources for other essential expenses or savings goals. Moreover, by focusing on the utilized portion, lenders can offer competitive interest rates, making real estate investments more accessible and appealing to prospective buyers in today’s market.

Benefits of Charging Interest on Utilized Amount

Charging interest only on the utilized amount in real estate transactions offers several advantages for both lenders and borrowers. This approach, often seen in loans with variable or adjustable rates, ensures that the interest paid is directly tied to the actual funds borrowed and used. Unlike traditional lending models where interest is calculated based on the entire loan amount, this method promotes responsible borrowing and efficient financial management.

For real estate investors and homeowners, this means lower overall interest costs when compared to fixed-rate loans. It allows borrowers to save money, especially during periods of declining market rates. Furthermore, it provides lenders with a risk mitigation strategy as the outstanding balance decreases over time, reducing the potential for significant losses if the borrower defaults. This system fosters transparency and fairness in real estate financing.

Implementation Strategies for Efficient Interest Collection

Implementing a system where interest is charged only on the utilized amount in real estate transactions can be a game-changer for both lenders and borrowers. To achieve this efficiently, financial institutions should focus on several key strategies. Firstly, digital platforms can automate the process of tracking and calculating interest based on the outstanding balance, ensuring accuracy and timely collection. These systems can also enable borrowers to easily monitor their loan progress and make informed decisions about repayments.

Additionally, establishing clear communication channels is vital. Lenders should educate borrowers about this interest structure and provide regular updates on their accounts, fostering transparency and trust. Regular reminders and automated notifications for upcoming payment due dates can significantly enhance collection rates. This approach not only streamlines the entire process but also encourages responsible borrowing and timely repayment.