The prime rate influences real estate financing through adjustable-rate mortgages (ARMs), affecting mortgage costs and feasibility. Variable rates offer investors flexibility, capitalizing on growth and protecting against rising costs. Robust credit analysis, diversification, and clear communication manage risk with variable rates tied to the prime rate. Lenders monitoring market trends ensure stability during volatile periods.

In the dynamic landscape of real estate, understanding variable rates tied to the prime is paramount for investors. This article explores the intricate relationship between these variables and their profound impact on financing. We delve into the advantages of variable rates, providing strategic insights for managing risks associated with prime-linked loans. By grasping these concepts, real estate professionals can make informed decisions, navigate market fluctuations effectively, and optimize investment strategies in today’s competitive sector.

Understanding Prime Rate in Real Estate Financing

The prime rate, often referred to as the “index” or “benchmark” rate, is a crucial variable in real estate financing. It’s the interest rate that banks and lenders use when lending money to their most creditworthy customers—typically large corporations and governments. In the context of real estate, understanding the prime rate is essential for borrowers seeking mortgages or other types of real estate loans.

Lenders often tie their adjustable-rate mortgages (ARMs) to the prime rate, meaning the interest rate on these loans can fluctuate as the prime rate changes. This provides both advantages and disadvantages for borrowers. On one hand, if the prime rate drops, so may the borrower’s mortgage rate, potentially saving them money in the long run. Conversely, when the prime rate rises, so could their monthly payments, making it a variable cost to keep in mind when planning for real estate investments or purchases.

Advantages of Variable Rates for Property Investors

For real estate investors, variable rates offer a range of advantages that can significantly impact their decisions and strategies. One key benefit is flexibility; these rates adjust based on market conditions, allowing investors to capitalize on changing trends. During periods of economic growth, variable rates can provide opportunities for higher returns as borrowing costs decrease, enabling investors to secure favorable terms for financing or refinancing properties. Conversely, in slower markets, variable rates may offer some protection against rising interest expenses, ensuring a more manageable cash flow.

Additionally, these rates appeal to investors seeking long-term strategies. By locking in lower interest rates during market downturns, investors can mitigate potential losses and stabilize their portfolio. This approach enables them to focus on property appreciation and rental income growth without the added pressure of rising debt costs. Variable rates thus provide a dynamic and adaptable financing solution for real estate investors, catering to diverse market scenarios and fostering strategic decision-making in an ever-changing landscape.

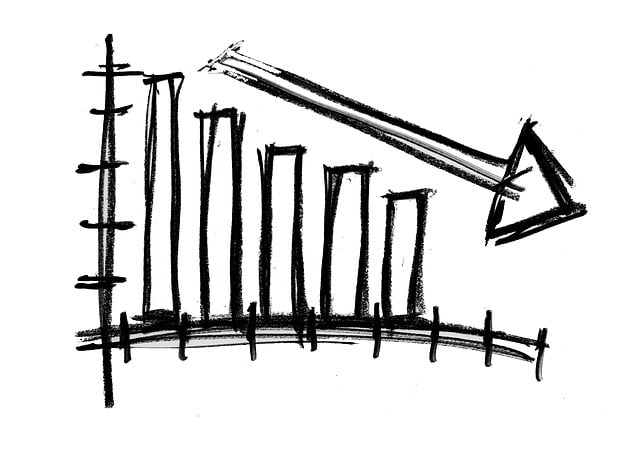

Strategies for Managing Prime-Linked Loan Risks

When dealing with variable rates tied to prime in real estate loans, managing risk is paramount. One key strategy involves implementing robust credit analysis frameworks. This includes meticulous assessment of borrowers’ financial health, cash flow patterns, and debt obligations to ensure they can withstand potential interest rate fluctuations. Diversification is another effective tool; lenders can spread their portfolio across various loan types and sectors to mitigate the impact of any single borrower’s default.

Additionally, establishing clear communication channels with borrowers is essential. Educating them about the variable rate structure, its potential implications, and available repayment options empowers both parties. Regular market monitoring is also crucial for lenders to adjust strategies proactively. Staying attuned to economic trends, industry insights, and changes in prime rates allows for timely intervention, ensuring a more stable lending environment, especially during volatile periods.