Advanced technology has fueled a booming global real estate market, democratizing access to international properties and streamlining transactions. Cross-border investments have increased due to economic interconnectedness, with major cities attracting foreign capital for residential and commercial development. Cultural factors significantly impact property practices, requiring adaptability from professionals navigating local customs, while varied buyer preferences demand tailored approaches for successful cross-border deals.

“Vibrant cross-border commerce, particularly in real estate markets, defines our globalized era. This article explores how traditions and cultures intertwine with international property transactions, fostering a dynamic landscape. We delve into the global exchange of properties, analyze investment trends across borders, and uncover the subtle yet powerful influences shaping these deals. Understanding these interactions is key to navigating and capitalizing on the ever-evolving world of real estate.”

Real Estate Markets: Global Exchange of Properties

In today’s globalized world, cross-border commerce has expanded beyond traditional trade, encompassing a vibrant exchange that includes real estate markets. The global real estate sector experiences dynamic growth as investors and individuals navigate international borders to capitalize on opportunities. This trend has fostered a unique blend of cultural practices and financial strategies, creating a fascinating landscape for those involved in the buying, selling, or renting of properties across nations.

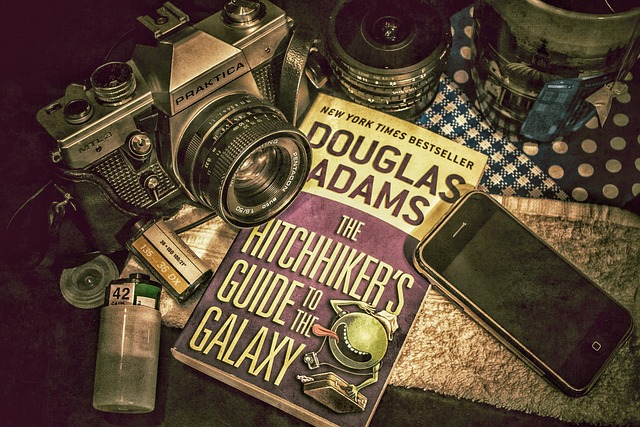

The ease of access to information and advanced technology have revolutionized real estate transactions. Prospective buyers can now explore diverse markets with just a few clicks, uncovering hidden gems or iconic landmarks as potential investments. This digital transformation has not only democratized access to global real estate but also encouraged a more transparent and efficient buying and selling process, further fueling the vibrant cross-border commerce traditions in this sector.

Cross-Border Investment Trends in Real Estate

Cross-border investment trends in real estate have seen a surge in recent years, reflecting the global nature of today’s economy. Investors are increasingly looking beyond their domestic markets to capitalize on the diverse opportunities offered by international properties. This shift is driven by several factors, including high returns, emerging markets with strong growth potential, and the desire to diversify investment portfolios.

As borders become more open and regulatory frameworks align, real estate has emerged as a prime sector for cross-border investments. Major cities worldwide are becoming attractive destinations for foreign investors due to their robust infrastructure, stable economies, and high demand for housing and commercial spaces. This trend not only fosters economic growth in host countries but also facilitates the exchange of architectural designs, cultural influences, and sustainable development practices across borders.

Cultural Influences Shaping International Property Deals

In the realm of international property deals, cultural influences play a profound role in shaping transactions and relationships. Each country boasts unique traditions, values, and norms that permeate their real estate practices. For instance, in some countries, negotiations are often driven by relationships and trust, with personal connections carrying significant weight. In contrast, others heavily rely on formal legal frameworks and explicit contracts, emphasizing transparency and predictability. These cultural differences demand adaptability from global real estate professionals, who must navigate delicate cross-border partnerships while respecting local customs.

Cultural nuances also manifest in property preferences and design choices. Some societies prioritize open, spacious living areas reflecting a community-focused lifestyle, while others value intimate, compact spaces that foster a deeper connection with nature or heritage. Understanding these influences is vital for facilitating successful international real estate deals, ensuring properties cater to the specific needs and desires of both local buyers and foreign investors.