Understanding loan defaults in the real estate sector is crucial for both lenders and borrowers. Default occurs when a borrower fails to meet repayment obligations, leading to legal protections for lenders like foreclosure proceedings and breach of contract lawsuits. Lenders mitigate risks through comprehensive property valuations, strict eligibility criteria, and proactive monitoring. By employing these strategies, lenders can recover assets while minimizing losses, empowering them to navigate real estate loan complexities effectively.

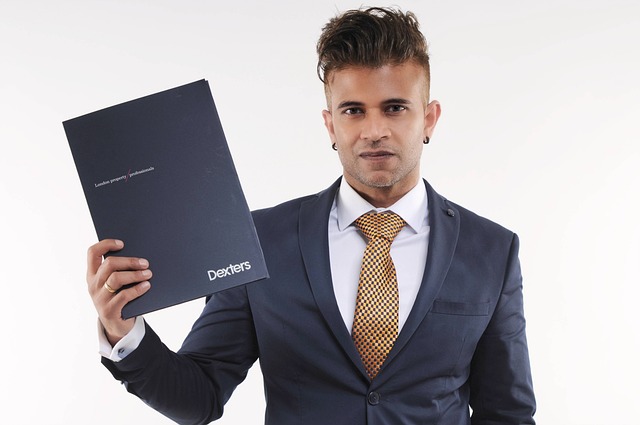

In the dynamic landscape of real estate, understanding borrower defaults is crucial for lenders aiming to secure their investments. This article delves into the intricacies of default in real estate loans, exploring legal protections and strategies that safeguard lender interests. From recognizing early signs of distress to implementing effective risk mitigation tactics, we provide insights essential for navigating the complexities of the market. By employing these measures, lenders can minimize losses and protect their assets in the event of borrower defaults.

Understanding Default in Real Estate Loans

When discussing real estate loans, understanding default is paramount for both lenders and borrowers. Default occurs when a borrower fails to repay their loan according to the agreed terms, often due to financial hardship or unforeseen circumstances. In the context of real estate, this can mean missing mortgage payments, failing to maintain property insurance, or not paying property taxes as required. Each of these scenarios triggers a series of actions outlined in the loan agreement, typically providing the lender with legal recourse to protect their investment.

Lenders carefully assess borrowers’ financial health and creditworthiness before extending real estate loans, but even the most diligent underwriting cannot account for every potential risk. In the event of default, lenders may initiate foreclosure proceedings to reclaim the property securing the loan. This process involves legal actions and public sales, with the proceeds used to satisfy the outstanding debt. Understanding these dynamics is crucial for borrowers aiming to avoid default and for lenders seeking effective strategies to mitigate risks associated with real estate loans.

Legal Protections for Lenders in Case of Borrower Default

In the event of a borrower defaulting on their real estate loan, legal protections are in place to safeguard lenders. These protections serve as a crucial component of the lending process, ensuring fairness and minimizing risk for financial institutions. One primary measure is the lender’s ability to initiate foreclosure proceedings. By legally seizing and selling the secured property, lenders can recoup their losses. This right is established through the deed of trust or mortgage agreement, which outlines the terms and conditions in case of default.

Additionally, lenders have the option to sue the borrower for breach of contract, seeking damages for the outstanding debt. They may also pursue other legal remedies, such as personal liability, if the borrower has personally guaranteed the loan. These protections enable lenders to mitigate financial risks associated with real estate loans and ensure their ability to recover investments in the event of borrower non-compliance.

Mitigating Risks and Securing Assets: Strategies for Lenders

When a borrower defaults on their loan, lenders face significant financial risks. Mitigating these risks is crucial for maintaining stability and securing assets. In the real estate sector, lenders can employ several strategies to safeguard their interests. One approach is to require thorough property valuations and comprehensive financial analyses before extending credit. This ensures that the collateral, often a piece of real estate, is of sufficient value to cover any potential defaults. Additionally, lenders can implement strict borrower eligibility criteria, focusing on responsible lending practices to minimize risk.

Another effective strategy involves regular monitoring and evaluation of the property’s market value and the borrower’s financial health. Staying proactive allows lenders to take swift action if market conditions or borrower circumstances change, potentially leading to a decline in collateral value. By staying informed, lenders can make informed decisions, such as restructuring loans or initiating foreclosure proceedings, ensuring they recover their assets while minimizing losses.