Securing long-term financial stability requires strategic goal setting aligned with future aspirations, beginning with assessing current finances and defining short-term/long-term goals. Investing in real estate, a proven game-changer, offers opportunities to build equity and generate passive income through rentals or property appreciation. Consider market trends, personal situations, and risk tolerance when setting goals; achieve set milestones for sustained motivation throughout financial planning. Diversifying a real estate portfolio across various property types and locations mitigates market volatility risks, while regular reviews and adjustments ensure successful growth.

“Achieving long-term financial stability requires strategic planning and a holistic approach. In this article, we guide you through the process of setting realistic financial goals and explore the powerful role of real estate in securing your future. From understanding the fundamentals of long-term wealth creation to implementing effective strategies, you’ll discover actionable insights. Learn how investing in real estate can be a game-changer for building generational wealth, offering both income generation and appreciation potential. Get ready to transform your financial trajectory.”

Understanding Long-Term Financial Stability: Setting Realistic Goals

Understanding long-term financial stability involves setting realistic goals that cater to your future aspirations. This journey begins with assessing your current financial standing and identifying your short-term and long-term objectives. One effective strategy is investing in real estate, a proven game changer for many. By acquiring properties, you not only build equity over time but also gain a steady income stream through rent or potential property appreciation.

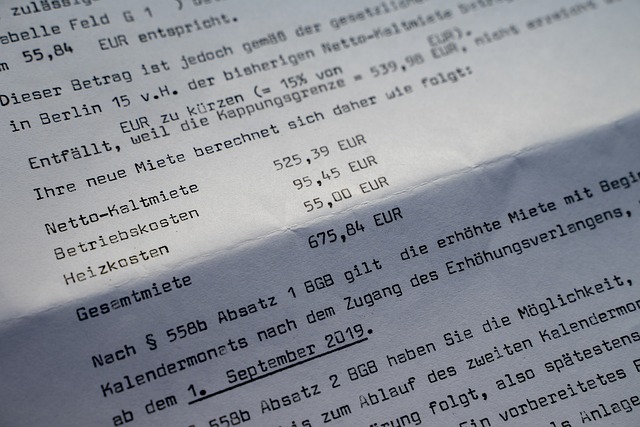

When setting goals, it’s crucial to consider factors like market trends, personal circumstances, and risk tolerance. For instance, if your primary goal is retirement, start by calculating the desired retirement amount and how much you need to save annually. In terms of real estate, this might mean researching rental yields, property values in desirable locations, or exploring opportunities for flipping houses. Setting achievable milestones keeps you motivated as you navigate the intricate landscape of financial planning.

The Role of Real Estate in Achieving Financial Security

Investing in real estate has long been recognized as a cornerstone for building long-term financial stability and security. It offers a unique blend of tangible assets and potential for consistent, often passive, income generation. The power of property lies not only in its ability to appreciate over time but also in providing a hedge against inflation, a common concern for investors aiming for financial security.

When considering real estate as part of your financial strategy, the options are vast. Whether it’s purchasing a rental property, investing in commercial spaces, or exploring real estate investment trusts (REITs), each avenue presents distinct advantages and potential returns. By diversifying your portfolio with real assets, you gain exposure to a market that historically demonstrates resilience during economic downturns, positioning you for substantial gains as markets recover.

Strategies for Building and Maintaining Long-Term Wealth

Building long-term financial stability often requires a strategic approach, and one of the most robust methods is investing in real estate. This asset class offers a unique opportunity for wealth accumulation over time through property appreciation and rental income. A well-thought-out real estate strategy can provide a steady stream of passive income, ensuring financial security in retirement or as a secondary source of revenue to supplement other income streams.

Diversification is key when building a long-term wealth portfolio. Investing in various types of properties across different geographic locations can mitigate risks associated with the market’s volatility. Whether it’s purchasing residential homes for rent, commercial spaces, or even land for potential future development, each option presents its own advantages and opportunities for growth. Regularly reviewing and adjusting your investment strategy based on market trends and personal financial goals is essential to maintaining and growing your real estate portfolio successfully.