Understanding Real Estate closing costs is crucial for successful property transactions, helping buyers and sellers prepare financially, avoid surprises, and make informed decisions by outlining expenses like title searches, appraisals, inspections, legal fees, and agent commissions, which are typically split between parties. By knowing these costs upfront, first-time buyers can budget accordingly for a smoother real estate journey.

In the dynamic realm of real estate, understanding closing costs and navigating final paperwork is paramount for a seamless transaction. This comprehensive guide breaks down essential aspects, ensuring you’re well-informed throughout the process. From defining and deciphering various closing cost components to demystifying the paperwork involved and leveraging legal professionals’ expertise, we equip you with strategies for efficient management. Maximize your knowledge and minimize surprises by embracing best practices tailored for real estate success.

Unpacking Closing Costs in Real Estate

In the world of real estate, understanding closing costs is a crucial step in navigating the home buying or selling process. Closing costs refer to the various expenses associated with finalizing a property transaction. These fees can vary widely and are typically split between the buyer and seller. Among these costs, you might find title search fees, appraisals, inspection services, legal fees for preparing contracts and documents, and even real estate agent commissions. By unpacking these closing costs, potential homebuyers and sellers can better prepare financially and make informed decisions.

Uncertainty around closing costs is often a common concern among first-time buyers or those unfamiliar with the real estate market. However, many of these charges are one-time fees that contribute to ensuring a smooth transaction. For example, a title search verifies the history of ownership and ensures there are no outstanding liens on the property, while an appraisal assesses the property’s value for loan underwriting purposes. Knowing what constitutes closing costs allows buyers and sellers to budget accordingly, avoid surprises, and ultimately make their real estate journey more seamless.

– Definition and significance of closing costs

In the realm of real estate, closing costs refer to the various expenses that buyers and sellers incur during the final stages of a property transaction. These costs extend beyond the purchase price and are an essential aspect to understand before finalizing any deal. From legal fees and appraisal charges to title insurance and taxes, closing costs can significantly impact the overall financial commitment of buying or selling a property.

Understanding closing costs is crucial for both parties as it allows them to budget effectively, avoid surprises, and make informed decisions. In the world of real estate, transparency and clarity regarding these expenses are vital for a smooth and successful transaction. Knowing what to expect can help buyers and sellers navigate the process confidently, ensuring a seamless transition from contract to ownership.

– Components included in closing costs

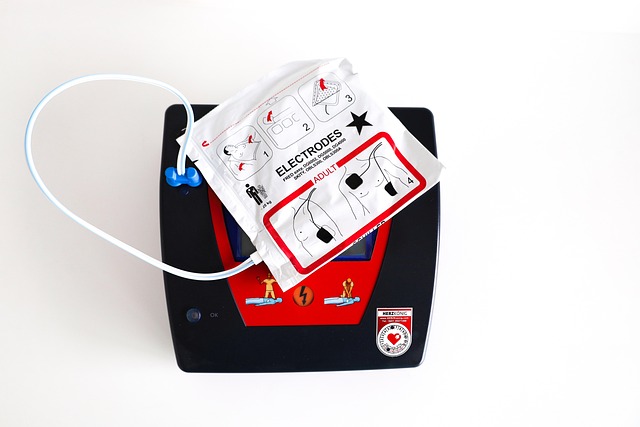

When it comes to purchasing a property in real estate, understanding closing costs is crucial. These are various expenses that go beyond the purchase price and include a range of fees associated with finalizing the transaction. Closing costs typically cover a variety of components, each playing a vital role in ensuring a smooth transfer of ownership. Among these, you might find appraisal fees, which are essential to determine the property’s value, and title search charges, crucial for verifying the clear ownership title.

Additionally, expect to encounter various legal fees related to preparing and reviewing contracts, as well as recording documents. Insurance costs, such as homeowners or mortgage insurance, are also commonly included. Furthermore, closing costs often include taxes and assessments, which can vary based on local regulations. These expenses collectively contribute to the overall financial commitment when buying a property in the real estate market.