A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their real estate investment's equity, offering flexibility for various purposes like renovations or debt consolidation with competitive interest rates and potential tax benefits. However, it's a significant commitment secured against the property, so homeowners should carefully assess their financial situation and risk tolerance before deciding, conducting thorough research, and exploring options from multiple lenders based on current market conditions.

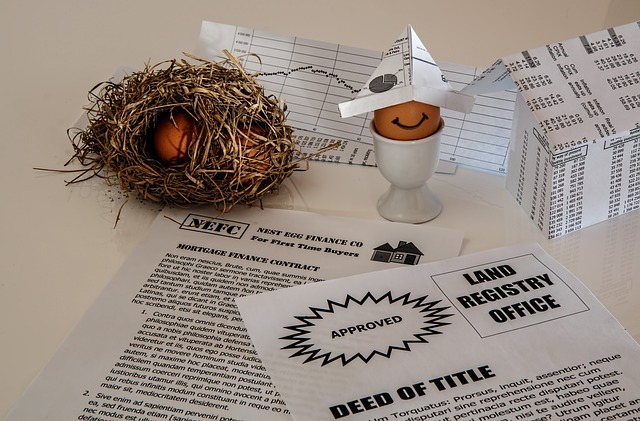

Considering borrowing against your home equity? A Home Equity Line of Credit (HELOC) offers a flexible way to access cash, utilizing your property’s value. This real estate strategy provides quick funds for various purposes, from home improvements to unexpected expenses. However, it’s crucial to understand the benefits and potential drawbacks before diving in. Learn how to navigate this process, explore key considerations, and make an informed decision regarding this popular real estate option.

What is a Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow against the equity they’ve built up in their real estate investment. It functions similarly to a credit card, with a revolving line of credit accessible through a lien on the property. This means you can withdraw funds as needed up to a pre-determined limit, making it a flexible option for various financial purposes.

HELOCs offer several advantages for real estate owners. They provide access to significant amounts of capital, allowing for substantial borrowing power. Moreover, interest rates are often competitive compared to other loan types. Homeowners can also enjoy tax benefits since the interest paid on HELOCs may be tax-deductible, depending on local regulations and loan terms.

Benefits and Considerations for Borrowing Against Home Equity

Borrowing against home equity offers a range of benefits for homeowners looking to access their real estate investment’s potential. One of its key advantages is providing a substantial and flexible source of funds. This type of loan allows property owners to draw on their home’s value, offering a line of credit that can be used for various purposes, such as home renovations, debt consolidation, or even funding education expenses. The flexibility in borrowing means homeowners can access funds as needed without the strict repayment schedule associated with traditional loans.

However, there are considerations to keep in mind. Borrowing against home equity involves a significant financial commitment as it is secured against the property itself. This means any outstanding balance reduces the owner’s equity in their home. Additionally, interest rates on these loans can vary, and homeowners should be prepared for potential fluctuations in market conditions that could impact their repayment terms. It is crucial to carefully assess one’s financial situation, goals, and risk tolerance before deciding to borrow against home equity to ensure a responsible and beneficial decision.

Navigating the Process: How to Borrow Against Your Home's Equity

Navigating the process of borrowing against your home’s equity involves understanding a few key steps. Initially, assess your real estate investment’s current value by consulting with a professional appraiser or using online tools provided by lenders. This step is crucial as it determines how much equity you possess and, consequently, the loan amount available to you.

Once you have a clear picture of your home’s value, contact various lenders to explore different loan options. Compare interest rates, terms, and conditions to find the best deal that aligns with your financial needs. Keep in mind that borrowing against home equity can be a significant financial decision, so it’s essential to thoroughly research and consider all aspects before proceeding.