Assessing responsibilities is key before entering the real estate market. Owning property involves various duties like maintenance, tenant management, and understanding local regulations, which can impact savings and time commitments. Investors must weigh these obligations against expected returns to ensure a sustainable approach, balancing financial goals with the complexities of homeownership in today's fast-paced world.

In the world of real estate, weighing responsibilities against overall savings is a delicate dance. Owning property comes with a myriad of duties—from mortgage payments and taxes to maintenance and management—that can significantly impact your financial health and quality of life. This article guides you through this intricate balance. We explore how assessing responsibilities, calculating potential savings, and prioritizing tasks can help you make informed decisions, ensuring both financial benefits and peace of mind in your real estate ventures.

Assessing Responsibilities in Real Estate Investments

When considering real estate investments, assessing responsibilities is a critical step that often gets overlooked. It’s important to remember that owning property comes with various duties and tasks that require time, effort, and financial resources. From maintaining the physical asset to managing tenants (if applicable) and staying updated on local regulations, each investment entails unique obligations.

In the world of real estate, these responsibilities can significantly impact overall savings. For instance, high maintenance costs or unexpected repairs can eat into profit margins. Additionally, the time commitment needed to manage a property effectively may hinder other financial goals. Therefore, before diving into the market, investors must carefully weigh these duties against their expected returns, ensuring a balanced and sustainable approach to real estate investments.

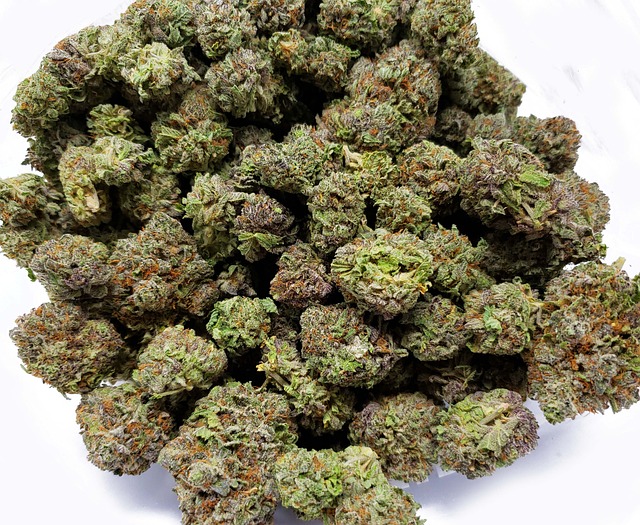

– The various duties and obligations tied to property ownership

Being a homeowner comes with a diverse range of responsibilities that often get overlooked in the initial excitement of purchasing a property. From regular maintenance tasks to legal obligations, these duties can significantly impact an individual’s time and financial resources. In the realm of real estate, owners are typically tasked with ensuring their properties remain in good standing, including routine repairs, seasonal upkeep, and addressing any immediate issues to prevent further damage.

Moreover, there are various legal responsibilities tied to property ownership. Homeowners must adhere to local zoning laws, building codes, and safety regulations. Staying informed about these requirements and ensuring compliance can be a continuous effort. Additionally, managing financial obligations like mortgage payments, property taxes, insurance, and potential home owner associations fees is an ongoing task that requires careful planning and budgeting skills.

– How responsibilities can impact financial health and quality of life

In today’s fast-paced world, managing responsibilities and financial goals often presents a delicate balance. The impact of one’s duties on financial health can be significant, affecting both short-term and long-term savings. For instance, in the realm of real estate, taking on additional responsibilities might hinder initial investments or savings for a down payment. This is because many individuals with demanding jobs struggle to allocate sufficient time and energy to grow their wealth, leading to a trade-off between professional pursuits and financial prosperity.

Furthermore, the weight of responsibilities can influence one’s quality of life. High-pressure jobs or extensive caregiving duties may leave little room for leisure activities or long-term planning. As a result, individuals might find themselves sacrificing personal well-being and financial security. Effective time management becomes crucial, especially when considering that a robust financial foundation is essential for navigating unforeseen circumstances and securing a comfortable future.