In real estate, gross lease arrangements simplify financial management by shifting costs from landlords to tenants. Covering taxes, insurance, maintenance, and utilities, these leases provide tenants with transparent rent structures and enable effective budgeting. For landlords, it offers cost savings, streamlined management, and competitive rental rate setting opportunities. Meanwhile, tenants bear operational expenses, requiring careful budget allocation, which can influence their real estate choices.

In the dynamic realm of real estate, understanding gross leases is paramount for investors and tenants alike. This comprehensive guide, “Understanding Gross Lease: A Comprehensive Guide,” delves into what exactly a gross lease entails—specifically, the total expenses included in the rent amount. By dissecting these costs, we explore how gross leases impact both real estate investments and tenant agreements, offering valuable insights for navigating this critical aspect of property management.

Understanding Gross Lease: A Comprehensive Guide

In the realm of real estate, understanding gross lease arrangements is paramount for both tenants and landlords. A gross lease, as the name suggests, involves the lessee covering all expenses related to a property, including taxes, insurance, and maintenance costs. This comprehensive guide aims to demystify this leasing structure, providing insights into its benefits and implications within the real estate sector.

Tenants opt for gross leases for their simplicity and convenience, as it eliminates the hassle of tracking and apportioning expenses. All financial obligations are bundled into a single payment, simplifying accounting processes. For landlords, gross leases offer a steady income stream without the complexities of managing individual expense items. This arrangement is particularly advantageous in commercial real estate, where negotiating and administering detailed lease terms can be time-consuming and challenging.

Decoding Total Expenses: What's Included?

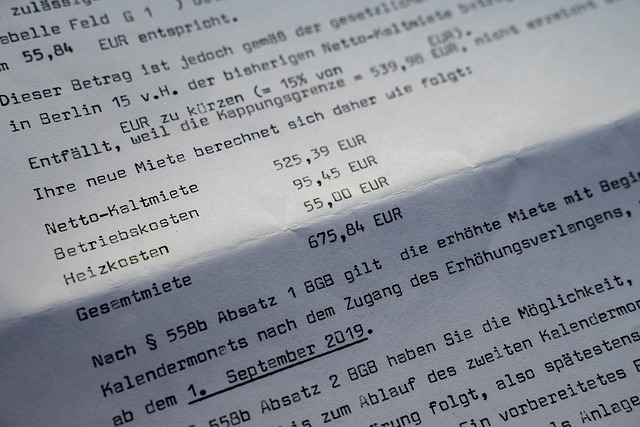

In real estate, understanding a gross lease and its components is crucial for both landlords and tenants. When we talk about total expenses in a gross lease, it encompasses a wide range of costs that are typically the responsibility of the landlord. These include property taxes, insurance, maintenance, repairs, and even utilities. By including these in the lease, the tenant benefits from a straightforward rent structure without hidden costs.

Decoding this aspect of a lease agreement is essential as it allows tenants to budget effectively and landlords to set competitive rental rates. Each expense itemized under total expenses contributes to the overall property management costs, ensuring a well-maintained and attractive real estate asset for all parties involved.

The Impact on Real Estate Investments and Tenants

In the realm of real estate, the concept of a gross lease, where tenants are responsible for covering all expenses, significantly impacts both investments and tenant relationships. For investors, this model can be a game-changer, offering potential for substantial cost savings and streamlined management. By offloading operational costs to tenants, landlords can attract a broader range of tenants with varied financial capabilities, fostering a vibrant and diverse portfolio.

Tenants, on the other hand, face the brunt of these expenses, which can significantly impact their budgets. While it provides clarity in lease terms, ensuring no unexpected cost surges, it places a greater financial burden on them. This dynamic may encourage tenants to carefully consider their operational budget allocation and potentially influence their real estate choices, favoring more cost-effective options or negotiating for variations in lease structures.