Real estate professionals rely on research comparables (RCs) to accurately assess property values by analyzing recent sales of similar properties within a specific area, factoring in attributes like size, age, amenities, location, and market trends. RCs are essential for navigating the dynamic real estate market, identifying patterns, adjusting pricing strategies, and making informed investment decisions based on comparable data from reliable sources such as government databases, industry reports, online platforms, and local realty boards. This comparative research approach enhances accuracy in valuations and forecasts, enabling professionals to adapt strategies and predict future market movements.

In the dynamic realm of real estate, understanding comparables is key to making informed decisions. This article delves into the art of utilizing research comparables to strengthen your stance in market analyses. We explore effective strategies for identifying relevant data sources, emphasizing the importance of accuracy and relevance. Through robust analysis techniques, you can gain valuable insights into property values, trends, and market dynamics, ultimately enhancing your investment strategies within the competitive real estate landscape.

Understanding Research Comparables in Real Estate

In real estate, research comparables (RCs) are essential tools for appraisers and agents alike. They involve analyzing recent sales data of similar properties within a specific geographic area to determine the value of a particular property under assessment. By studying these comparables—which can include factors like size, age, amenities, location, and market trends—professionals can make informed decisions about pricing and investment strategies.

Understanding RCs is crucial in navigating the dynamic real estate landscape. They help in identifying patterns, assessing market conditions, and adjusting expectations accordingly. For instance, if a property under consideration shares comparable attributes with recently sold homes that achieved premium prices, it could indicate strong demand and potential upward value movement. Conversely, if similar properties have experienced slower sales or lower values, it may suggest a need for strategic adjustments in marketing or pricing strategies.

Identifying Relevant Data Sources for Strengthened Stance

In the realm of Real Estate, fortifying one’s stance with robust data is paramount. The initial step involves meticulous identification of credible and relevant data sources. These can range from government databases tracking property values and market trends to industry-specific reports and analyses from reputable organizations. Online platforms offering comprehensive real estate insights and local realty boards are also valuable resources, providing access to historical sales data, current listings, and market updates.

For a strengthened position, it’s essential to leverage these sources to gather comparable data for properties similar to the one under consideration. This comparative analysis allows for informed decisions, enabling professionals to assess market conditions, identify price ranges, and understand the factors influencing property values within a specific area or demographic.

Crafting a Robust Analysis with Comparative Research in Real Estate

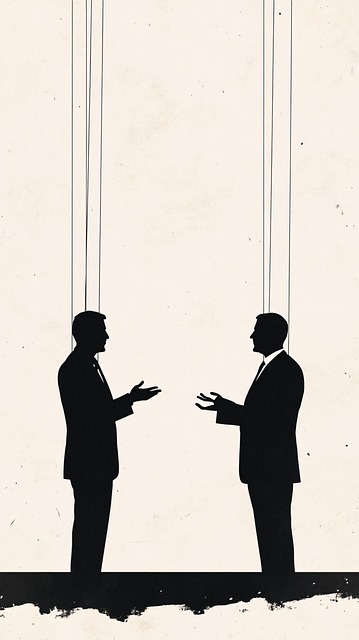

In real estate, crafting a robust analysis often requires navigating complex markets and understanding market dynamics. Comparative research plays a pivotal role in strengthening one’s stance by providing context and insights into property values, trends, and potential investment opportunities. By studying comparable properties—those similar in terms of location, size, age, features, and recent sales data—investors and analysts can make more informed decisions. This approach allows for a nuanced understanding of the market, enabling them to set realistic expectations and make strategic moves.

Incorporating comparative research enhances the accuracy of valuations, forecasts, and overall market assessments. It helps in identifying patterns, such as price appreciation rates, occupancy levels, or rental yields, which can guide investment strategies. Moreover, it facilitates a comprehensive analysis of property performance over time, enabling professionals to predict future trends and adapt their approaches accordingly. Ultimately, this method ensures that real estate decisions are data-driven and aligned with market realities, fostering success in an ever-changing industry.