The aging population and evolving lifestyle preferences are driving a boom in the retirement and vacation real estate market, presenting significant opportunities for investors and developers. To capitalize on this trend, professionals should innovate with multi-generational communities, eco-friendly designs, enhanced amenities (like high-speed internet, fitness centers), and accessibility features. A strategic approach focusing on location, demographics, and holistic development—including commercial and recreational spaces—is key to successful, long-term investments in a market characterized by growing demand for age-friendly housing and lifestyle amenities.

The global landscape of retirement and vacation destinations is evolving, driven by shifting demographics and changing travel trends. Understanding market trends in real estate offers vast opportunities for growth, particularly in catering to aging populations seeking idyllic retirements or affordable holiday homes. This article explores key strategies, from developing amenities-rich infrastructure to investment approaches, guiding the expansion of desirable retirement and vacation communities worldwide, all while leveraging the potent sector of real estate.

Understanding the Market Trends: Unlocking Opportunities in Retirement and Vacation Real Estate

The retirement and vacation real estate market is experiencing significant growth, driven by an aging population and evolving lifestyle preferences. As people live longer and seek more diverse travel experiences, there’s a rising demand for well-designed properties that cater to these changing needs. Understanding this trend opens up a plethora of opportunities for investors and developers.

This shift in market dynamics presents a unique selling proposition for real estate professionals. By recognizing the growing desire for comfortable, accessible, and engaging retirement and vacation spaces, they can develop innovative solutions. These might include creating multi-generational communities, designing eco-friendly accommodations, or building properties with enhanced amenities and accessibility features. Staying ahead of these trends ensures that investments in real estate remain robust and appealing to a wide range of consumers.

Developing Amenities and Infrastructure for Desirable Destinations

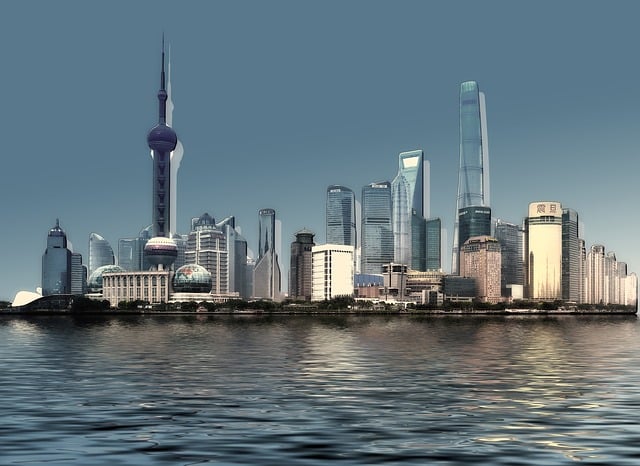

As retirement and vacation destinations gain popularity, developing amenities and infrastructure becomes crucial for attracting and retaining visitors. Modern retirees seek vibrant communities with easy access to healthcare, cultural events, and top-notch real estate options. Investing in robust transportation networks, including efficient public transit systems and well-maintained roads, enhances the overall experience. Additionally, destinations that offer a diverse range of accommodation types—from luxurious resorts to affordable rental properties— cater to various preferences and budgets.

The inclusion of world-class amenities like high-speed internet access, fitness centers, and recreational facilities contributes to desirable locations. These factors create an appealing environment for active retirees who value health, wellness, and engaging social interactions. Moreover, investing in sustainable practices and eco-friendly infrastructure can attract nature-loving visitors seeking peaceful retreats while ensuring the preservation of local ecosystems.

Strategies for Investing and Growing Retirement Communities: A Comprehensive Approach

Retirement communities are evolving to meet the needs of an aging population, and a strategic approach to investing in real estate is crucial for their growth. Developers and investors should consider a holistic strategy that includes location, amenity offerings, and the target demographic. By understanding local market dynamics and trends, such as the demand for age-friendly housing and lifestyle amenities, investors can make informed decisions. Diversifying portfolio holdings across different asset types within retirement communities—including residential, commercial, and recreational spaces—can also mitigate risks and enhance long-term sustainability.

Additionally, leveraging technology to improve community management and resident engagement is a game-changer. Smart home integrations, digital health monitoring systems, and online platforms for social interaction not only attract tech-savvy retirees but also contribute to their overall well-being. A comprehensive investment strategy should prioritize sustainable development practices, energy efficiency, and accessibility features to create appealing retirement destinations that cater to the diverse needs and preferences of future residents.