In real estate, identifying and managing contingencies like financing, inspections, appraisals, and legal clearances is vital for smooth transactions. Real estate agents guide clients through these complexities, ensuring expectations are realistic and challenges are anticipated. Effective contingency management protects buyers, sellers, and lenders from unforeseen events, market fluctuations, or property issues, fostering reliable buying and selling experiences.

In the dynamic realm of real estate, evaluating contingencies and financing reliability is paramount for both buyers and sellers. This comprehensive guide navigates the intricate process of identifying potential issues early on, from defining contingencies like financing, inspections, and appraisals to understanding market trends and their impact. We explore various financing options, strategies for risk mitigation, and the crucial roles of professionals in ensuring stability throughout real estate transactions.

Identifying Contingencies in Real Estate Transactions

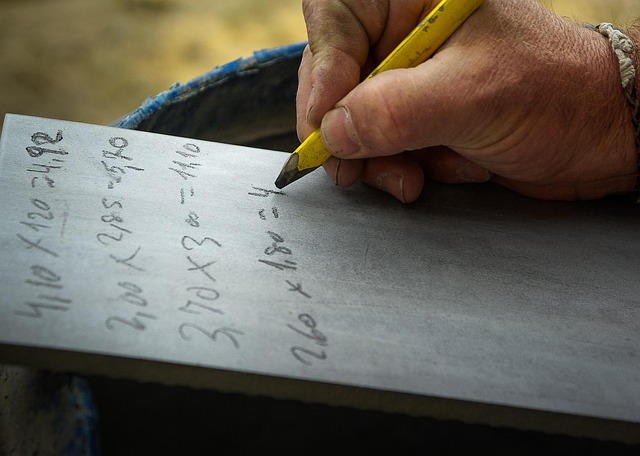

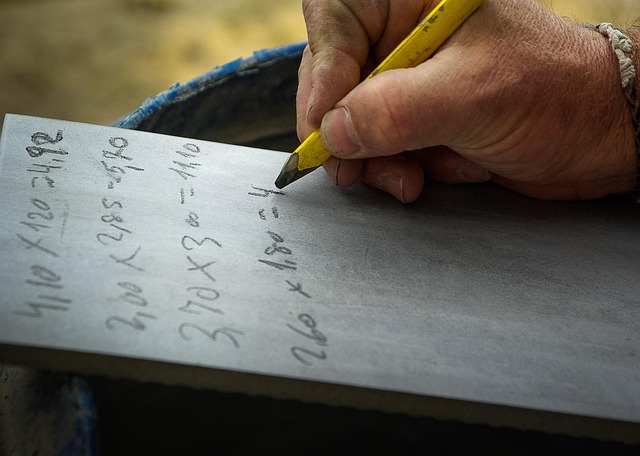

Identifying contingencies is a critical step in any real estate transaction. These are conditions that must be met for a deal to close, and they can include various factors such as financing, inspections, appraisals, and legal clearances. For instance, in most real estate deals, buyers and sellers agree on a specific financing contingency, where the buyer’s mortgage approval is a prerequisite for completing the purchase.

Real estate agents play a vital role here by helping clients understand and navigate these contingencies effectively. They guide their clients through potential issues, ensuring they have realistic expectations and are well-prepared to address any challenges that may arise during the transaction process, ultimately fostering a smoother and more reliable buying or selling experience.

– Defining contingencies

In the realm of real estate, contingencies are unforeseen circumstances that can impact a property transaction. These could include structural issues revealed during an inspection, changes in market conditions affecting the property’s value, or legal challenges related to ownership. Understanding and managing these contingencies is crucial for both buyers and sellers, ensuring a smooth and reliable financing process.

Evaluating contingencies involves careful assessment of potential risks. Buyers and their agents often include contingencies in purchase agreements, allowing them to back out of a deal if specific conditions aren’t met, such as securing financing or satisfaction with a property inspection. For lenders, reliability is paramount; they must assess the stability of both the borrower and the real estate market to guarantee loan approvals and mitigate potential losses.

– Types of contingencies in real estate (financing, inspection, appraisals, etc.)

In real estate, contingencies are potential obstacles or conditions that must be met for a transaction to close successfully. These can include financing contingencies, where the buyer’s ability to secure a loan is evaluated, and inspection contingencies, which involve assessing the property’s condition and identifying any repair needs. Appraisals also play a critical role, ensuring the property’s value aligns with the purchase price. Other contingencies may relate to legal or environmental issues, such as zoning regulations or historical site designations.

Understanding these contingencies is essential for both buyers and sellers. Buyers must be prepared to address any financing, inspection, or appraisal-related concerns promptly to avoid delays or potential deal breakdowns. Sellers, on the other hand, should disclose all relevant information about the property’s history and condition to facilitate transparent negotiations. Effective contingency management is a cornerstone of reliable real estate transactions, ensuring that all parties involved have clear expectations and are protected from unforeseen challenges.