In the dynamic real estate market, variable rate loans offer flexible financing with interest rates tied to the prime rate, initially attracting borrowers through lower payments. However, these loans expose homeowners to increased costs if rates rise, necessitating careful financial management during economic shifts. The prime rate, set by banks, significantly impacts loan rates and the broader sector, affecting construction, rental rates, and property values. While variable rates provide flexibility, buyers should assess their financial tolerance and consider fixed-rate mortgages for stable long-term costs.

In today’s dynamic real estate market, understanding variable rate loans is crucial for both borrowers and lenders. This article delves into the intricate relationship between variable rates and the prime rate, offering insights that can guide informed decisions. We explore how these loan interest fluctuations impact homebuyers and investors, highlighting benefits and considerations specific to the real estate sector. By grasping these concepts, folks navigating the market can make strategic choices, capitalize on opportunities, and steer clear of potential pitfalls.

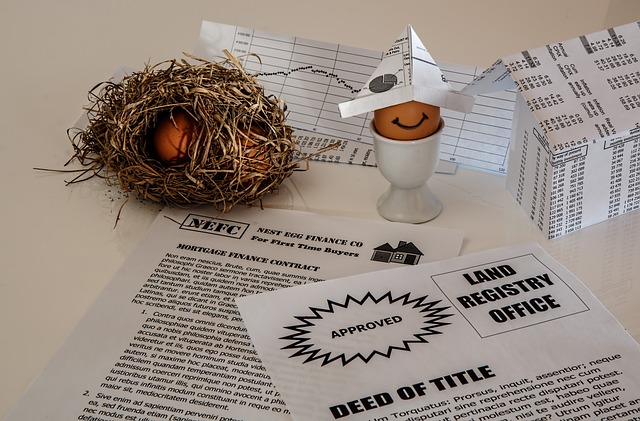

Understanding Variable Rate Loans in Real Estate

In the real estate market, understanding variable rate loans is crucial for both borrowers and lenders. These loans offer a flexible interest rate that fluctuates based on market conditions, typically tied to an index like the prime rate. This means that as the prime rate changes, so does the loan’s interest rate, providing both opportunities and challenges for homeowners.

Variable rate loans appeal to folks seeking lower initial monthly payments, as they can take advantage of declining interest rates over time. However, there’s also a risk of higher payments if rates increase. In today’s dynamic market, this type of loan allows borrowers to navigate the ebb and flow of the economy, but it requires careful financial management and awareness of potential rate adjustments.

The Connection Between Prime Rate and Loan Interest

The prime rate, often referred to as the benchmark interest rate, is set by banks and significantly influences loan rates across various sectors, including real estate. When the prime rate fluctuates, so do the interest rates on mortgages, commercial loans, and other forms of credit. This connection is vital for both lenders and borrowers in the real estate market. As the prime rate rises, borrowing costs for properties increase, potentially slowing down property investments and purchases. Conversely, a decrease in the prime rate can stimulate activity by making mortgages more affordable, encouraging buyers to enter the market or secure better terms on existing loans.

In times of economic uncertainty, central banks often adjust the prime rate as a tool to manage inflation and stabilize the economy. Such changes have a ripple effect on the real estate sector, affecting everything from construction costs to rental rates and property values. Understanding this relationship is crucial for both financial institutions offering loans and individuals looking to invest or secure financing in the real estate market.

Benefits and Considerations for Borrowers in the Real Estate Market

For borrowers in the real estate market, variable rates tied to the prime rate offer both advantages and potential concerns. One key benefit is flexibility; as the name suggests, these rates fluctuate based on the prime rate index, allowing homeowners to potentially save on interest payments if rates drop. This can be particularly advantageous during periods of economic downturn or when interest rates are declining, providing borrowers with more financial wiggle room.

However, there’s a catch. Variable rates also mean that if market conditions change and the prime rate increases, so will your loan interest rate. This could lead to higher monthly payments, impacting borrowers’ budgets. It’s crucial for real estate buyers to understand these variables, assess their financial tolerance, and consider alternative fixed-rate mortgages if they prefer more predictable long-term costs.