When exiting a real estate investment, align your strategy with financial goals and market knowledge. Evaluate initial investment reasons, stay informed about local trends, and assess financial returns, market appreciation, and occupancy rates. Consider selling or refinancing, understanding the pros and cons of each, while deeply understanding the local market and planning meticulously to maximize returns.

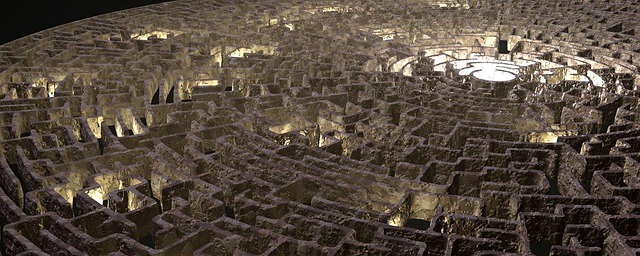

“Navigating the intricate path of exiting an investment in real estate requires a strategic approach. This comprehensive guide assists investors in understanding their goals and market position before evaluating their investment’s performance. By delving into key metrics, we explore how to execute a successful exit strategy, whether through selling or refinancing. Gain insights into the critical steps to ensure a profitable and smooth transition out of your real estate venture.”

Understanding Your Goals and Market Position

When planning an exit from a real estate investment, understanding your goals and market position is paramount. This involves assessing your initial reasons for investing in the first place—whether it was to generate rental income, achieve capital appreciation, or both. By clearly defining these objectives, you can strategically tailor your exit strategy to align with your financial aspirations.

Additionally, staying informed about the real estate market dynamics is crucial. Keeping a pulse on local trends, property values, and tenant demand allows you to gauge the optimal timing for an exit. For instance, if the market is experiencing a surge in prices due to increased demand, selling at that point could maximize your returns. Conversely, recognizing signs of a slowing market might prompt a more patient approach to ensure you secure the best possible outcome when ready to sell.

Assessing Your Investment's Performance

When planning an exit from your real estate investment, it’s crucial to assess the performance of your asset thoroughly. Start by evaluating the financial returns; have your rental properties or property investments generated a consistent profit margin over time? Consider both short-term gains and long-term potential. Analyze market trends in your area to understand if values are appreciating, which can indicate a favorable exit point. Keep an eye on occupancy rates and tenant satisfaction levels, as these factors impact the overall health of your investment.

Look beyond financial metrics. The real estate market is dynamic; consider external influences like economic shifts, local development plans, and demographic changes that might affect property values. Assessing your investment’s performance also involves gauging its impact on your portfolio. How does this asset diversify your investments? Understanding these aspects will help you decide the optimal timing for exiting and ensure a successful transition.

Executing the Exit Strategy: Selling or Refinancing

When executing an exit strategy for a real estate investment start, the primary options are selling or refinancing. Selling involves marketing your property to potential buyers, ensuring it’s priced competitively based on market trends and recent sales of comparable properties. This approach offers quick liquidity but might require compromising on the asking price. Alternatively, refinancing allows you to pay off the existing loan and potentially secure new financing with different terms, such as a lower interest rate or extended repayment period.

Refinancing can provide breathing room and enhance cash flow management, especially if market conditions have changed since your initial investment. However, it’s crucial to consider the overall financial impact, including any associated costs and fees. Both strategies require meticulous planning and an understanding of the local real estate market to make informed decisions that maximize returns on your investment.